Solving America’s student loan debt crisis…

Politicians make bold promises about solving the student loan debt crisis in America. If we ran for office, our promise would be ending the student loan debt crisis one family at a time!

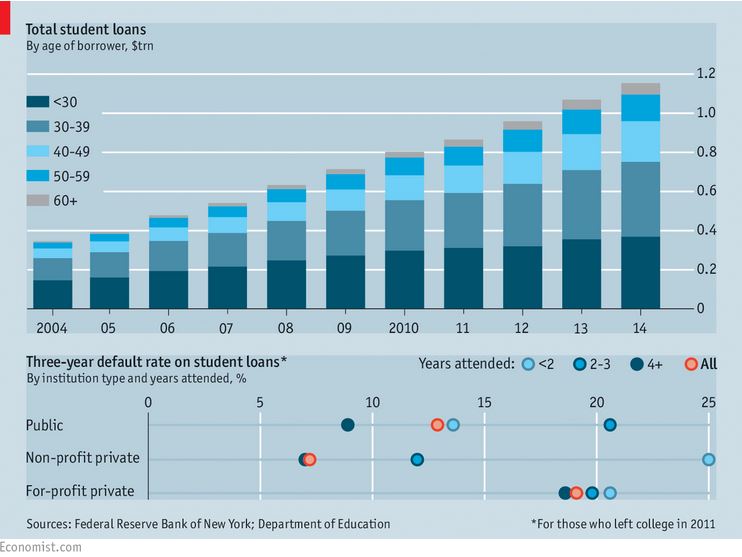

The facts are staggering. Student loan debt is skyrocketing as evidenced by this graph from The Economist

In 2004, the total student loan debt was $400,000,000,000. In 2017, it has soared to $1,400,000,000,000—that’s “trillion” with a T! At the current rate, this number will double by 2022.

Rising college costs and shrinking financial aid are forcing middle class families to turn to student loans to pay for their child’s education.

Two out of three students are graduating with student loans owing on average over $30,000. “More than half of millennials with current or past student loans say they’ve put off major life decisions because of the debt.” (Mark Williams, Columbus Dispatch, 8/11/15) They’re putting off life decisions like getting married, buying a home, and starting a family. Even more alarming (if that’s possible) is that 35% of student loan borrowers are delinquent on payments. So what is your family to do?

Our mission at Capstone is to make families more knowledgeable about the process so you make informed college buying decisions. With knowledge comes the understanding and the ability to avoid the crushing debt load for our graduates.

Let’s not rely on legislators to grant loan forgiveness. Let’s know how to navigate the college system and create a realistic plan to graduate on time with manageable student loan debt.

Here are our 6 steps to end the student loan debt crisis one family at a time:

1. Seek out the facts and be informed consumers of a college education.

Recognize college is big business. College costs and processes have changed drastically since many of us went to school. They are aggressively competing to get the best possible students they can, and the process has become extremely complex. You need to know what the “net cost” to attend that college is and which colleges will give you the most scholarship money to attend. You need to ask questions like “what is your 4-year graduation rate?”, “what is your job placement %?”, and “what is the average starting salary for graduates with a degree in my major?”.

2. Begin planning now.

You have to be pro-active and not reactive. Do NOT wait until your student is a high school junior or senior and think you’ll have plenty of time to plan. Besides the obvious lack of time to build a savings, you need to have facts about college costs and what your family can afford long before you start those visits to campuses. If you are like me, you love your alma mater. However, if your alma mater will be $45,000 a year with no financial aid prospects and would result in $100,000 plus in student loans, you may need to temper expectations.

3. Beware of friends and news outlets.

The world of college finances is a hot button topic and will continue to evolve. Like everything else in the news, sensationalism sells. You need to stay informed on college planning topics but be sure to carefully consider if what you are reading applies to your family. Yes, there are scholarships for left handed drummers but does that matter to you? Find your favorite resources—newspapers, blogs, social media—and stay in-the-know but take it with a grain of salt. What may be a great strategy for one family may be completely wrong for you. (We are dedicated to helping you stay informed with our social media posts on Facebook and Twitter and our once-a-week newsletter–click to sign up here.)

4. Don’t choose a school just for the name brand or ranking.

Recently we shared an article written by a high school valedictorian faced with choosing between Georgetown, a full priced $67,000 highly ranked name brand, and Fordham, a college which fit her academically and would give her a full tuition scholarship in their honors program. She discovered her worth is not defined by the college she chooses to go to, but by the dream she aspires to. We can share many reports and articles demonstrating this fact over and over again. Just because your student can get into their dream school does not mean you can afford it. I would love to drive a Ferrari, but it isn’t in my budget.

5. Determine your own criteria for a great college experience.

If you listen to students in the hallway of a high school, you will find they are often talking about choosing a school based simply on the beauty of its campus, the ranking given to it in a magazine, the location, or the lure of a name brand. As parents, we cannot let those things be the determination of our child’s attendance without digging deeper to ensure the academic, social, and financial fit. You need to know what kind of financial aid a college awards and if your child would have a high probability of graduating on time with manageable student loan debt.

6. Understand how loans work and their impact on the future and a student’s financial well-being.

The fact is at some point, your student may have to take out a student loan. Two out of every three college graduates in 2014 had student loans—a financial reality. After you have done all your research, saved what you could, chosen a college that fits you academically and financially, and received your financial aid offer, you may be forced to look at loans. What to do then?

| You have saved $30,000. Tuition=$15,000/year. | Example #1 | Example #2 | ||||

|---|---|---|---|---|---|---|

| From Savings | Federal Loan | Other Loan | From Savings | Federal Loan | Other Loan | |

| Freshman Year | $15,000 | $0 | $0 | $9,500 | $5,500 | $0 |

| Sophomore Year | $15,000 | $0 | $0 | $8,500 | $6,500 | $0 |

| Junior Year | $0 | $7,500 | $7,500 | $7,500 | $7,500 | $0 |

| Senior Year | $0 | $7,500 | $7,500 | $4,500 | $7,500 | $3,000 |

| Result | $15,000 | $15,000 | $27,000 | $3,000 | ||

We recommend not borrowing more than the estimated first year salary of your student. For example, if the average starting salary in your chosen field is $40,000, your total student loan debt should never exceed that number. You can search Payscale for potential salary information.

Look at a sample budget. Your student needs to be aware of what the budget will look like based on their salary and loans. Using the total amount of your loan, see how the monthly payment will affect everything else in that budget—rent, food, etc. We know they don’t want to continue eating ramen noodles well into their 30’s. They need to know just how much student loan payments will cramp their style.

Politicians want your vote and will come up with various plans to solve the crisis, and we hope their plans are good ones. However, legislative plans are only a small part of the big picture. Don’t wait for them to figure it out. Follow our 6 steps and your family can be ready to face this challenge head on. Vote Capstone!