Families $2,500 • Couples $2,000 • Single $1,500

One time fee

Experience is everything

Picture it: peace of mind.

Imagine having the freedom to focus on the things that give you energy.

Live life boldly and leave markets, planning approaches and tax strategies to us.

If you believe a sound plan can be the foundation for achieving great things, you’re in the right place. Trust your financial future to a community of advisors, financial specialists and peers who believe in living well.

Your best interests are at the center of our evidence-driven approach. You, your family, your goals and your most important dreams all play an important role in crafting a plan that embraces and improves the most important aspects of your life.

When you choose to work with us, your plan is backed by financial planning insights and decades of peer-reviewed financial research showing the right way to invest.

When you work with us:

You achieve clarity.

Live your life now, and when you think about the future, be confident you’ll end up exactly where you want to be.

You feel empowered.

Know your financial strategy incorporates layers of hard evidence and is designed around your true needs and wants.

You gain a partner.

Get comfortable sharing your values and goals with a fiduciary advisor who puts you at the center of your strategy.

Life isn’t linear.

A clear path on life’s winding road.

Navigating your finances through each phase of life requires more than just a plan. It requires a partner. Through life’s ups and downs, your advisor will be there to add insight, offer reassurance and amend your plan so you may reach your ideal future.

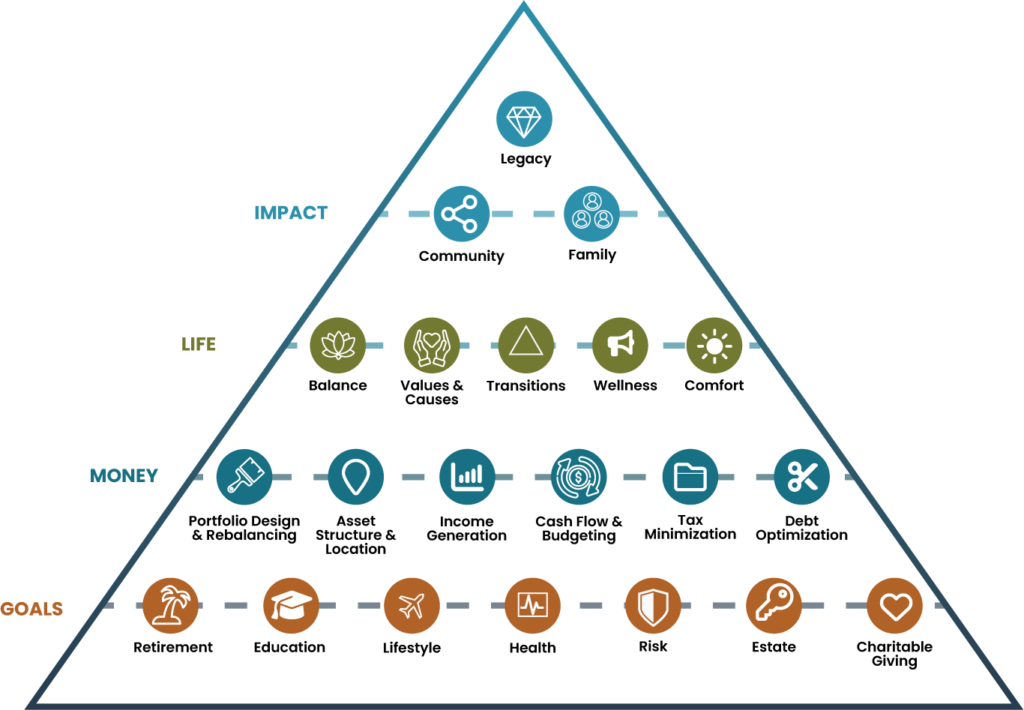

The Elements of a Financial Strategy

Money, goals, life and impact — your financial strategy is more than just investment decisions. Your dreams and passions are too important to leave to chance. A sound financial plan encompasses every aspect of your life and is built to last.

Your strategy begins with you.

What do you really want? To support your favorite causes? To send your children or grandchildren to college? To feel confident you have enough? Your life—your dreams, desires and the impact you want to make on this world— are the starting point for our evidence-driven planning approach.

Discover the path to security and freedom.

Let data bring you peace of mind. Work with your advisor to control what you can: taxes, fees and risk. Your portfolio will contain diversified stock funds; high-quality bonds; and, in some cases, alternative investment strategies.

You deserve the brightest minds on your side. An investment strategy driven by rigorous, peer-reviewed research gives you the best chance at reaching your goals. The strength of your plan comes from advanced strategies rooted in academia plus a committee-based approach to investment policy.

The power of

partnership.

When you work with us, you’re supported by a diverse team of resources and specialists. As we sit with you to develop your personal financial strategy, our strategic partnerships help ensure you get a well-conceived plan designed to meet your long-term goals.

What Sets Us Apart

At Capstone, we prioritize your needs with a unique approach:

- Custom Planning First: Unlike many firms that require asset transfers upfront, we start by creating a tailored financial plan based on your goals and values.

- Ongoing Comprehensive Relationship: We work together to get your entire financial house in order and keep it that way as your planning needs evolve over time.

- Client-Centric Focus: As an independent fee only fiduciary, we do not sell commissionable products and we put your best interest ahead of our own.

By focusing on planning and flexibility, we distinguish ourselves from traditional advisory firms that prioritize asset management from the start.

Our Process

Step 1: Foundation Plan

Embark on a personal discovery process alongside your advisor to identify elements of your life that will shape the design of your financial strategy. Your advisor will build a custom plan with clear objectives and attainable action items. Created & delivered in four meetings over a 30-day period.

1st Meeting

GET ACQUAINTED

- Discuss your goals & values

- Identify your opportunities & weaknesses

- Explore working with our advisory practice

2 Weeks Later

GET ORGANIZED

- Collect your Financial Inventory

- Set up your Personal Financial Website

- Assess your financial experience

2 Weeks Later

GET A PLAN

- Establish measurable financial goals

- Build your financial plan together

- Finalize saving strategies

30 Days

GET AHEAD

- Specific action list delivered at final meeting – implement with us or on your own.

Step 2: Capstone Planning

A continuance of advice, as delivered by your Foundations Plan, in a retainer-style relationship. Regular check-ins help protect your plan and allow you to measure progress toward your goals and adjust as needed.

- Full implementation of your initial plan’s action items on your behalf.

- College affordability advice – aid projections, FAFSA filing, net cost comparison, award evaluations, and loan decisions.

- Regular six-month progress meetings to review your situation, adjust your plan and provide accountability with on demand meetings throughout the year as needed.

- Planning and coordination in advanced areas – insurance, tax, estate.

- Coordination with your accountant & attorney as needed.

Families $300/mo • Couples $250/mo • Single $200/mo

(This fee is waived at certain managed Investment Management portfolio levels)

Step 3: Investment Management

0.25% – 1.00% ANNUALLY

(% assessed only on assets directly managed)

- Institutional-style investment approach for personal investors.

- Academic research and investment committee oversight from Buckingham Strategic Partners.

- Advisory fees debited directly from your accounts.

- Implementation with low cost mutual funds, exchange traded funds (ETF’s) and separately managed accounts (SMA’s).

- Optional use of sustainable and socially responsible portfolio strategies.

- Monthly custodial statements and quarterly performance reports (paper or eDelivery).

- Learn more about our Evidence – Driven Investing™

Ready to Start Your Holistic Wealth

Experience?

Experience a sense of calm

and confidence when you collaborate with your advisor to create a plan that’s right for you.

Experience a smarter way to invest and plan

with a financial strategy infused with decades of evidence-driven research.

Experience the best of both worlds

through a personal relationship with an advisor backed by national thought leadership resources and intellectual insight.