How to Succeed at Competitive Financial Aid Appeals

The start of a new year means the start of financial aid award letters arriving in your mailbox. And now, the real work begins — determining which college is the

as we work together to craft a personalized financial plan guided by your goals and values.

At Capstone Wealth Partners, we’re not your typical financial advisors. We’re committed to The Capstone Way – putting your needs first through transparent, goals-oriented planning and sustained support. Let us help you achieve financial clarity and confidence, no matter what stage of life you’re in.

• Commission-based or asset-under-management (AUM) fees, always trying to get more assets under their “umbrella” or sell you something you don’t need.

• They start with assets first – trying to manage your investments or come up with a strategy before they even know you, your family, or your goals.

• Transactional, with a focus on product sales, investment strategy, and limited face time.

✓ We are a fee-only firm, not trying to sell you insurance products or invest all your assets with us.

✓ We start with a comprehensive goals-based plan to organize your priorities, then build a customized financial strategy.

✓We are a trusted partner, providing ongoing guidance, education, and a listening ear – here to help you work through life’s wins and challenges, and adjust your plan accordingly in each new season.

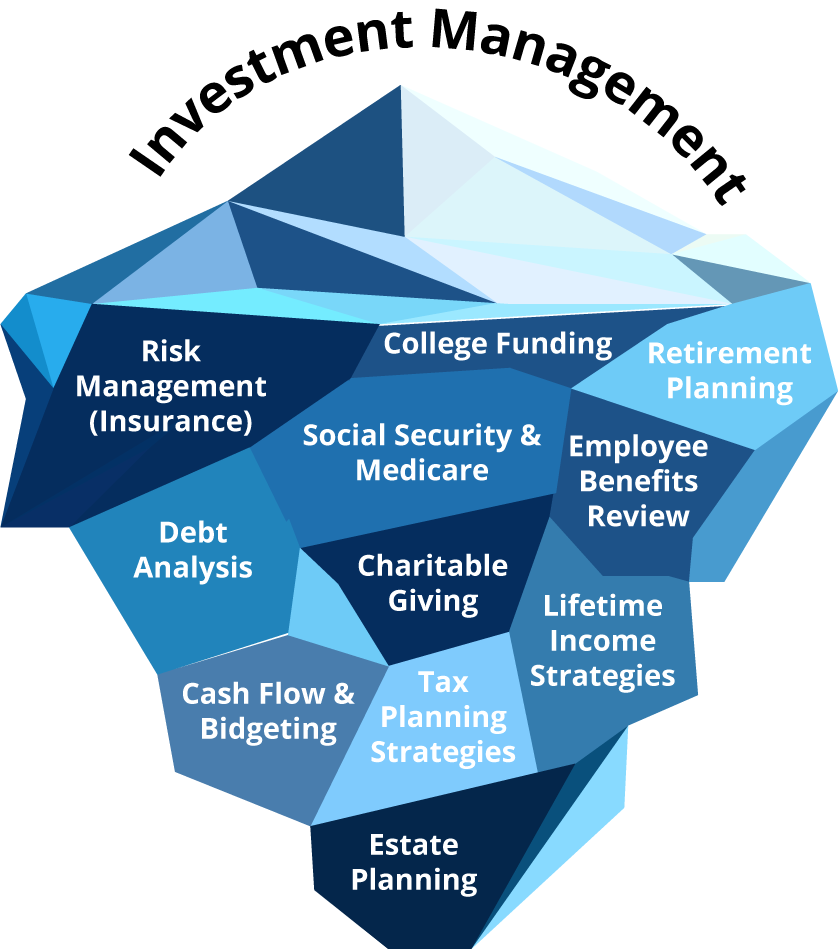

There is more to financial planning than just investment management. The Capstone Way is a comprehensive approach that prioritizes your unique needs and goals. This method integrates the many aspects of your financial life into a cohesive strategy.

Schedule a call to see if our services are right for you

The start of a new year means the start of financial aid award letters arriving in your mailbox. And now, the real work begins — determining which college is the

When parents think of paying for college, they think of scholarships. They often hear stories about students winning full rides, or applying for a range of unusual private scholarships that

There has been a lot of news in recent months about the ACA enhanced subsidies expiring at the end of the year. Extending the beefed-up subsidies has been at the

Sign up for our weekly newsletter to get our best ideas on saving and paying for college.

Register for “Understanding + Challenging Your Aid Package”