On this blog, we normally skip the technical stuff and stick to financial planning topics relating to major life decisions, such as retirement and college planning, but given the obvious, I thought it an apt time to change gears and discuss investing this week.

Unless you’ve had your head in the sand, you know that stock markets have given investors quite a roller coaster ride recently. In fact, the S&P 500 has had a total drop of 10% over the last 10 days. It’s since managed to recover over half of those losses, but even so, losing 5% still hurts. It’s a feeling most investors haven’t felt since the financial crisis of 2008.

The real question is, what are you doing about it? My hope is…wait for it…nothing much.

We’ve Seen This Movie Before

Like many investors, you’re probably wondering what’s next. Will markets recover? Or keep going down?

But the biggest risk at this point isn’t the market, it’s how you react to all the hype and emotion surrounding it. If history is a guide, too many people will lose their nerve, make emotional decisions, and lose lots of money.

As Warren Buffet has so aptly stated before:

“The stock market is a device for transferring money from the impatient to the patient.”

As financial planners, one of our core responsibilities is to help coach client behavior and avoid proving Buffet’s point. One of the ways we do this is by providing historical context.

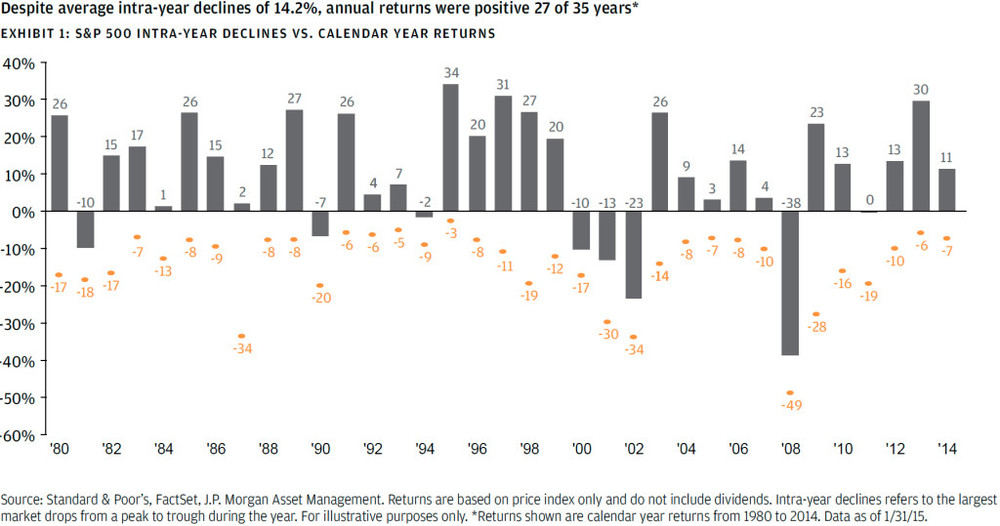

Let’s take a look. Going back to 1980, the average intra-year decline for the S&P 500 has been -14.2%. Kinda scary at first, right? However, during this same time period, annual returns have been positive 27 of the 35 years (77% of the time) and have actually provided investors with an average annual return of 11.6% (assuming no fees & dividends reinvested). Ahem, I’ll take that, please and thank you.

Since early 2009, the S&P 500 index has more than doubled, and we’ve gone almost four years without a 10% correction. Market corrections are completely normal—and healthy—during bull markets. For one, they can realign the prices of stocks that have risen too far, too fast. Corrections can also help to head off potentially devastating bubbles.

Clearly, no one has a crystal ball. The market may continue its rocky decline, or it may bounce back like it’s done so many times before. In either case, we’re confident it will eventually be a distant memory. Remember, free-market capitalism continues to be hard at work in the world, rewarding those who take market risks for proportional returns: stocks > bonds > cash.

The key is to remain disciplined long enough for this to occur.

Quick, Look Over There!

I totally understand. It’s not easy watching the markets twist and turn. That’s why I encourage you to turn your attention elsewhere right now.

Why? Research actually shows the more frequently you check your portfolio, the more likely you are to make short-sighted decisions with your money, hurting your chances for solid long-term performance.

As a rule of thumb, if you’re checking your portfolio more than once per quarter, you’re doing it too often. There’s a reason our firm provides performance reports to clients only four times a year…and we’d do it less if compliance allowed ; ).

Actions To Take (Aside From Panicking)

For most of our existing clients, we’ve helped you focus on the distant horizon, not the turbulence immediately in front of you. However, if you’re obsessing over the market and your investments, we encourage you to take a break. Rest assured, though, we as your advisors do not sit idly by when markets decline. While we cannot control the markets, we can control how we respond to them.

When markets fall, we diligently hew the fundamentals of good portfolio management:

- We remain calm when others are panicking. We are here to help you stay disciplined when you cannot. Emails, phone calls, and brief meetings are all welcomed.

- We rebalance into declining markets. Yes, that means taking from winners and contributing to the asset classes which have underperformed––a steadfast technique that forces you to partially “sell high” and “buy low”.

- We harvest tax losses in order to offset capital gains from current or future appreciated investments. In addition, we take advantage of market volatility to minimize estate taxes, where appropriate.

In short, bad markets = lemons, but we like to make them into lemonade. At least, partially so.

Time To Re-evaluate?

Now, I’m certainly not saying you should throw in the towel on your portfolio right now, but market declines can definitely be a trigger point to re-assessing portfolio strategy. We all feel good with investment risk as markets rise, but it’s a very different feeling when the opposite occurs.

If you’re like many investors, it’s very likely that at some point in the past, you (maybe along with your advisor) came up with an “optimal” asset allocation mix of stocks and bonds, as intended to fund your goals. And while you probably recall laying eyes on your “expected rate of return” for said allocation, it’s possible that you did not fully appreciate the downside possibilities (ahem, right now) associated with it.

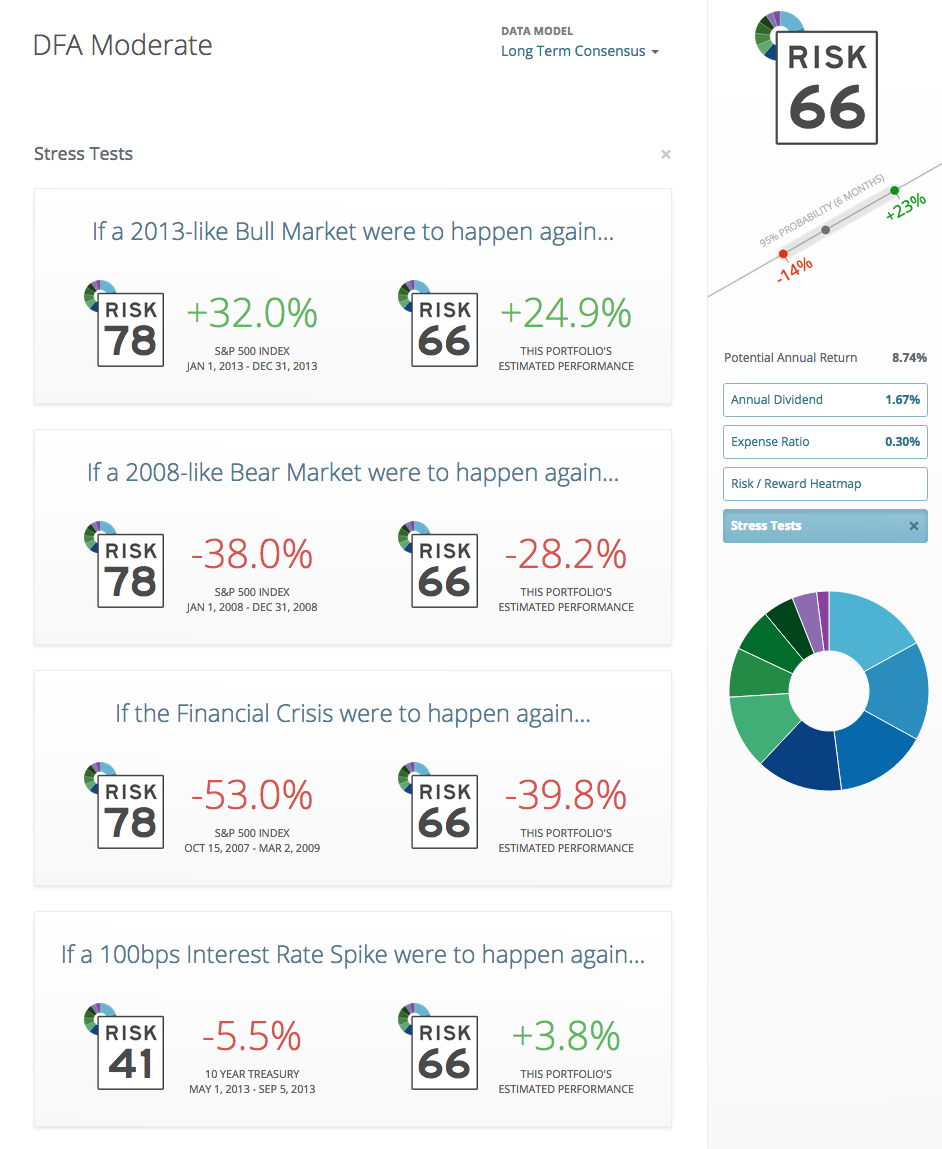

Want to know if you’re “getting what you ordered”? Then, I suggest you look at your portfolio’s risk level and stress test it. You should know and be comfortable with your portfolio’s possible outcomes at any given time. Here’s an example for one of our middle-of-the-road model portfolios, which has a Risk Number of 66 on a scale of 1–100 :

Your Risk Number

Do you know your personal “risk numbers”, both in bull and bear markets? If so, are you comfortable with them? If not, then it may be time to re-evaluate “what you ordered”.

Want to know your personal Risk Number? Click on the button below for complimentary access to our firm’s online risk profiling assessment, which we use regularly with our investment clients. No strings attached, we promise.

I’ll leave you with one final quote from investing legend Peter Lynch:

“Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves.”