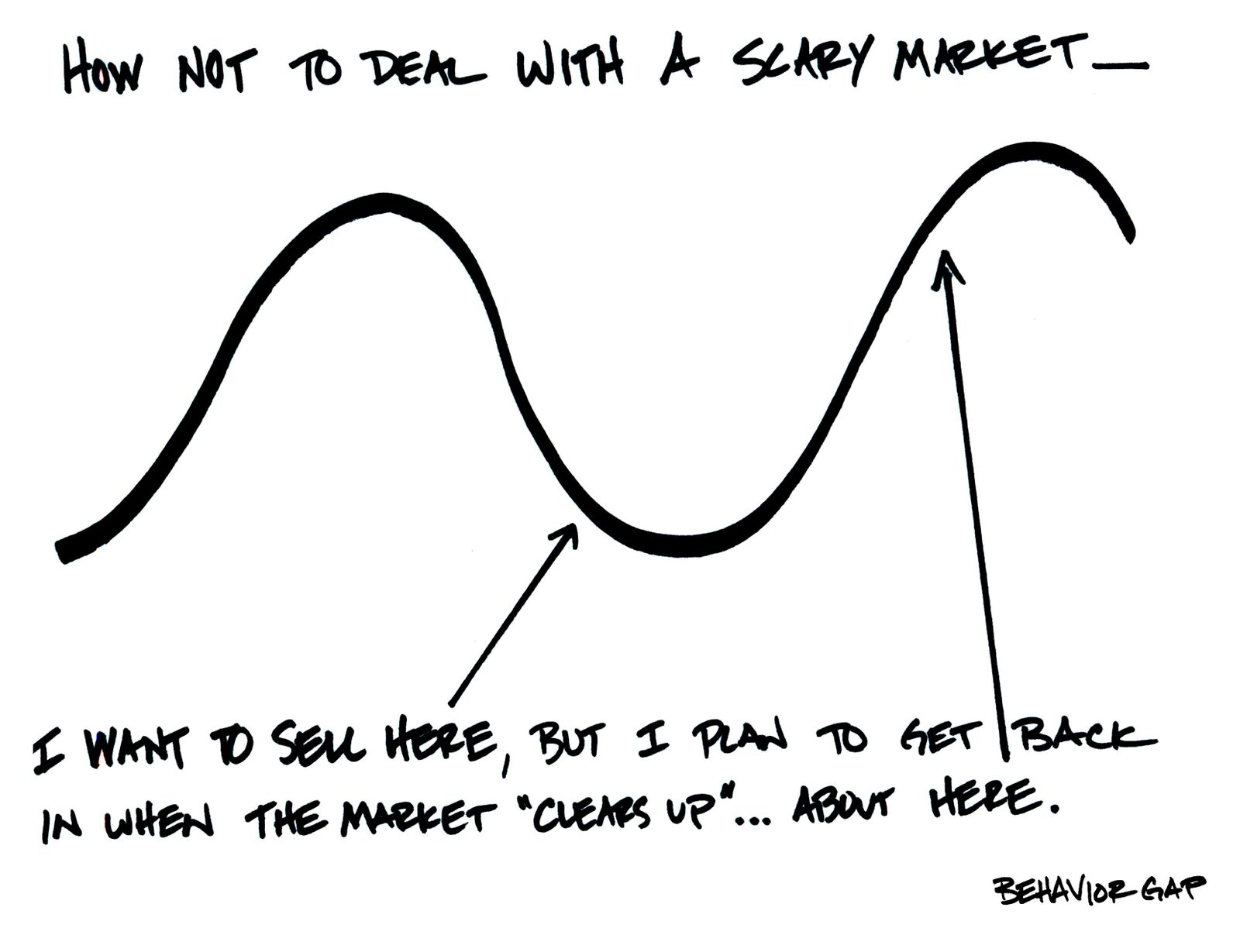

Photo Credit: BehaviorGap.com

“Sell everything… We think investors should be afraid.”1

“Stronger US Dollar, weaker oil/commodity prices, weaker world trade, weaker EM (and global growth)… and repeat. The economy seems trapped in a death spiral.”2

While similar comments were likely on CNBC or tweeted over the last 72 hours, these two particular quotes come from two years ago, by the Royal Bank of Scotland and Citigroup respectively. This was also the last period of any significant market volatility in recent years, with a decline of over 10% on the S&P 500 from the start of 2016 to February 11, 2016.

Yet since February 2016, we’ve seen stocks hit new highs seemingly every day, with the S&P 500 gaining 45%. In fact, 2017 was the first calendar year on record for the S&P 500 which saw every single month record a positive performance.

Which brings us to this week.

With stocks seemingly having nowhere to go but up, the recent reversal was a shock to many complacent investors. The declines seen last Friday and this past Monday brought most U.S. stock markets down about 6%. In point terms, the Dow Jones industrial average fell by nearly 1,800 points. The 1,175-point fall on Monday was the largest single-day point loss in the history of the Dow, but nowhere near a record percentage loss. (Remember that a 1,000-point move on the Dow is equal to a 10% move when the Dow is at 10,000, but only a 4% move when the Dow is at 25,000.) In percentage terms, it was the worst loss since the U.S. credit rating was downgraded in 2011.

With a huge run-up, and a recent pullback, what will happen next?

Surely in the days to come, we’ll see a variety of pundits making all kinds of wild predictions. Try and tune out the noise. Think about these declines in the context of the returns we have seen over the last few years. If you were not alarmed by the value of your portfolio around the end of the year, then today’s value shouldn’t be alarming either. Right now, the S&P 500 is around where it was in late November of 2017. As a reminder, that’s less than three months ago (see chart below).

S&P 500 Return 1/1/16 – 2/8/18

Source: Yahoo! Finance, 2018. S&P 500 Index Price Level. Indexes are unmanaged baskets of securities that are not available for direct investment by investors. Index performance does not reflect the expenses associated with the management of an actual portfolio. Past performance is not a guarantee of future results. All investments involve risk, including loss of principal.

If you’re worried about stocks losing say 20% from their highs, this would take you back to where the S&P 500 was trading last summer.

And this is not factoring in any fixed income allocation (i.e. bonds) in your portfolio. Bonds have likely gained, or at least maintained, ground the last few days, helping buffer the impact of the declines in stocks.

It is human nature to want to avoid losses, and anchor on performance peaks, but if you were not panicked about your portfolio six months ago, you may still be in better shape than you think.

Short-term declines do not negate the long-term potential of markets to grow wealth. And that is what really matters.

Additional required reading for 529 investors:

Please let this recent market volatility serve as a public service announcement for being a prudent investor with your 529 college savings plans. Over the last couple years, we’ve seen and heard of parents becoming overconfident with the allocations in the 529 plans of their college-bound teenagers — holding onto, or even increasing, their equity allocations as stocks have continued to outperform bonds as of late.

This can prove to be especially dangerous once your student reaches high school and you are within just a few years of account withdrawals. A sharp market downturn (e.g. this past week) can prove to be devastating, and leave you with not enough time from which to recover. And, if you’re like most of our clients, you’ll need every penny in that 529 plan to help fund college expenses in the very near future. Simply put, reasonably protecting your accumulated balance is far more important (and controllable) than eeking out a few extra dollars in gains.

If you’ve got a 529 plan for a newborn or toddler, there’s no need to panic. There’s plenty of time for a (more than likely) market recovery. And besides, most of your future 529 plan balance is yet to be contributed (assuming you’re making regular contributions ????). In fact, there’s a bit of a silver lining in that you’ll be buying stocks “on sale” for a while following a market decline.

Your best bet? For our clients here in Ohio, we recommend the ready-made age-based portfolio options from CollegeAdvantage (our state’s direct 529 college savings plan). Depending on your personal risk preference, you can choose one of four pre-built diversified investment portfolios that automatically reduces risk as your child gets closer to college age. Not only are these portfolios managed by highly respected The Vanguard Group, they also use commission-free index funds that are very low cost.

A professionally managed portfolio that’s easy to understand, simple to use, and is very inexpensive? In the famous words of Michael Scott, that’s a “win win win”.

1 “Sell everything! 2016 will be a ‘cataclysmic year,’ warns RBS,” Jim Boulden, CNN Money, Jan 12, 2016

2 “Citi: World economy seems trapped in a ‘death spiral’,” Katy Barnato, CNBC, Feb 5, 2016