Why More Families Are Turning to Independent Educational Consultants

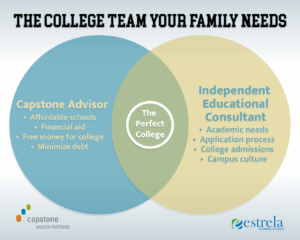

Today, I’m featuring a guest post from Amber Gilsdorf, Director of College Planning at Estrela Consulting, LLC, a multi-consultant college planning firm based in Ohio. Amber supports and mentors all