To encourage saving for college, many states in the US allow for an in-state tax deduction up to a certain amount for savings invested in that state’s 529 plan. Starting in 2018, the state of Ohio has doubled the available deduction for residents from $2,000 to $4,000 per year and per beneficiary for investments made to their plan–College Advantage.

Ohio families need to consider if investing in the College Advantage plan is right for them if they are currently investing somewhere else (or not at all—a good time to start!). Residents in other states who can deduct 529 investments on their taxes should also be thinking about their choice of plan.

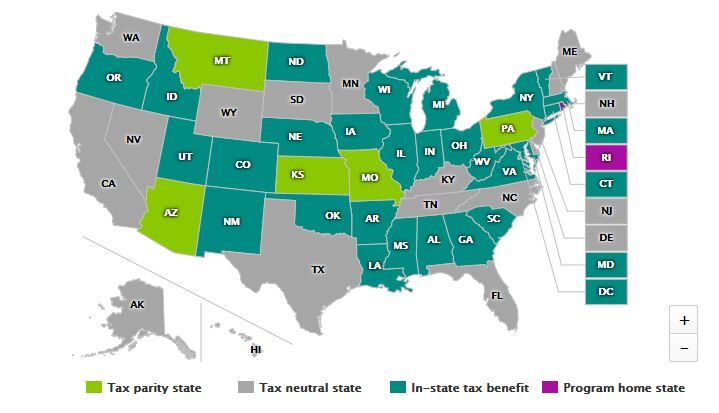

For a quick check of how much each state’s residents can deduct on their taxes, check out our friends at Savingforcollege.com. The map below also lets you know at a quick glance if there is any state tax benefit.

Note…tax parity states allow you to deduct up to a certain amount on your state taxes whether you invest in that state’s plan or in another state’s plan.

Going with Ohio or another state?

Should Ohio 529 investors choose their state plan? Residents of any state can invest in any plan. They are not limited. To decide if a family’s state plan is right for them, consider the amount of the tax savings versus the performance of the investment in another state.

Say an Ohio family was paying approximately 4% on their state income taxes. They fund two 529 plans and can take up to a $4,000 deduction per plan or $8,000 total for the year. 4% of $8,000 is a $320 savings on their taxes. Will their investment in another state’s tax plan earn them $320 more in a year?

Transferring 529 money from one plan to another

If an account owner has discovered they can realize a tax savings by investing in their state’s 529 plan but have already opened a plan in another state, they can transfer from one plan to another. Keep in mind that 529 rollovers are allowed once per 12-month period per beneficiary NOT per plan. If there are two plans for a single beneficiary, both cannot be rolled over during the same year.

How much can be invested in a 529 each year?

As a side point, the $4,000 amount is not a cap to how much you can invest per year. It is the amount of your investment you can deduct on your Ohio taxes each year. To avoid annual gift tax consequences, the annual maximum amount invested must be less than $15,000 for a single taxpayer or $30,000 for a married filing jointly couple. These figures are newly increased for 2018.

Carry forward deductions (and contributions)

Good to know…say a married couple invested $20,000 in their child’s Ohio 529 this year. They can claim the $4,000 deduction over a period of 5 years—carrying that contribution into the future. We call that ͞front loading.͟

In the same way, a contribution can be spread out over 5 years to avoid the gift tax penalty. If a married couple invested more than $30,000 in one year, they can carry forward the surplus over $30,000 into the following year(s) up to a maximum of $150,000 (or $75,000 for single filer).

Managing cash flow while in college

Some families may stop funding their 529 once a child enters college. However, families should consider running the cash flow through the 529 to receive the tax benefit. Although the compounding interest benefit is lost for this type of short term turnaround, the tax deduction is still saving money.

Final thoughts

While the state tax deduction is a nice benefit for 529 investment, the strongest reason to invest in a 529 is the tax-deferred growth and tax-free withdrawals for qualified expenses. However, when planning to pay for college every penny is key so checking out a state’s 529 tax rules can be beneficial.