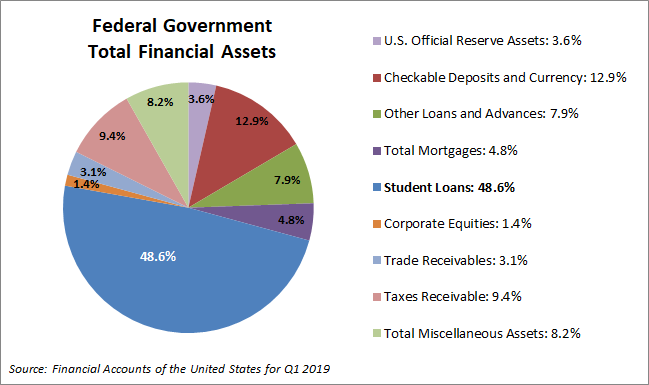

Everyone owes money (well, almost everyone). The government owes money. We read a lot about the government’s deficit–the debt we owe other countries due to our spending. The United States deficit exceeded $22 trillion back in February. Americans owe money. We are bombarded with student loan debt statistics. The total student loan debt in the US reached $1.56 trillion in February 2019. (Mortgage debt is the only personal debt amount that exceeds the total student loan debt at approximately $15.5 trillion.) What we don’t often think about is how much money the US government is collecting on student loans. Believe it or not student loan debt is the single largest financial asset for the government. (See the chart below.) Student loan debt accounts for over 48% of the total financial assets of the government. So does the government really want to bring down the amount we are borrowing to go to college? Are they addicted to student loans?

What happens when this debt is not repaid?

Currently (as of 2/2019), over $101 billion in student loan debt was in default–not being paid. Loans in deferment or forbearance, when payment is delayed, totaled over $235 billion. That is a lot of money for the government not to be actively collecting. If colleges and universities are being paid a large sum of money and the government is not currently being paid back for, it might make you a little nervous.

It should be noted that being forgiven a student loan debt is not an easy task. Bankruptcy does not automatically forgive this debt. A borrower needs certain circumstances to have their loan forgiven like permanent disability or situations like teacher loan forgiveness. If a loan goes into default, the loan goes to collection, federal and state tax refunds are withheld, and wages can be garnished.

What does the government suggest when someone is struggling to pay their loan?

A repayment plan! A repayment plan basically extends the life of the loan from the standard 10 years to 25 years (or more). You can read more about repayment plans here. Yay…the government is helping. But are they?! Every time someone elects an income based repayment plan, the government nearly triples it’s interest receivable over 25 plus years instead of the standard 10.

Student loan debt is having a huge impact.

Student loan debt has an impact in other areas of people’s lives. A 2019 Federal Reserve report estimated that student loan debt accounted for about 20% of the decline in home ownership among young adults, a two percentage point decrease in the home ownership rate. People who don’t own homes don’t pay for insurance, maintenance, utilities, furniture, etc. Many industries and retail businesses are impacted by the decrease in home ownership.

Young people with student loan debt are also delaying getting married, having children, or making large purchases. They can’t afford to save for retirement. The impact on spending is affected by high student loan debt. The impact will be felt across many industries for many years.

Consider this from Forbes? “In other words, the damage that student loan debt can do to the economy isn’t going to wake us up one morning with a slap in the face like Lehman Brothers—rather, it’s a slow but steady sinkhole that is quietly gobbling up any hope for sustainable long-term growth in the U.S. economy.”

Equate this to unhealthy habits like eating fast food, drinking excessive amounts of soda, or smoking. We are all well aware that these things aren’t good for you. However, each time you binge on fast food or have a cigarette you don’t die on the spot. You get the temporary satisfaction you crave and go about your day. All the while, these habits are slowly but surely eroding your health until one day your body hits a breaking point as a result of years of unhealthy habits.

Accountability

Currently, the primary beneficiary of the student loan program, the colleges, have no incentive to lower their costs. Federal student loan debt interest rates are very low. Colleges know students can simply borrow the money. “They practically have no skin in the game. If students default on their loans, there is no bad effect for the school.”

After the recession, state funding of colleges was slashed. Colleges made up the lost funds by increasing tuition. If the price of a car jumped in the way that college funding did, you simply wouldn’t have purchased the car. However with college tuition, the cost of borrowing money is so low consumers are willing to buy it. Plus, what have you got to lose? You don’t have a car to be repossessed or a home to go into foreclosure. Student loan debt is the can we kick down the road. Students don’t even realize what their future will look like.

Has the government’s lending been “responsible”?

Seth Frotman, a former student loan official who resigned from the Consumer Finance Protection Bureau (CFPB), told a House committee, “(Student loan debt) is a significant — perhaps the most significant — consumer finance issue threatening our nation at this time.” He was talking about the risks to our economy because of a lack of consumer spending due to the level of student loan debt.

J.P. Morgan Chase CEO Jamie Dimon wrote in his annual letter, “We would be well-advised to have more properly designed underwriting standards around the creation of student loans. Direct government lending to students has grown almost 500% over the last 10 years – and it has not all been responsible lending.” Unlike mortgages or car loans, student loans are not tied to a physical asset. Students are borrowing on the basis of their future earning potential. Also, loans to students have few underwriting guidelines. Students do not need to have certain credit scores.

Of course, it is not practical for students to have a credit score per se, and we want to encourage students of all means to be able to acquire a higher education. Loans may be the only way to make that happen.

However, the government currently is not taking action against those colleges who are the worst offenders in the student loan game–for-profit colleges. In 2011, 70% of all default loans were from those who attended for-profit or to a lesser extend 2-year community colleges. These graduates are not getting the higher paying jobs. They are promised a future, told they can pay for it with cheap student loans, and then not having that dream realized. The government is not holding these schools accountable.

What is the danger?

We all know that by partaking of too much fast food, soda, or cigarettes we are putting our health at risk. We may still do it, but we know it isn’t good for us. In the same way, everyone knows that this massive student loan debt is bad for our financial health too. Families, colleges, and the government all know the risks we are facing, but we are all slow to do anything real about it.

As student loan debt continues to grow, the economy will become more sluggish because people can’t afford to spend money on other things. The government’s “loan” asset will continue to get larger. The risk of default will also expand. We, the taxpayers, are the ones at risk as the government continues to be addicted to student loans, and colleges are not held accountable for the cost of their product.

Updated August 1, 2019