Updated April 2022.

For recent college graduates, investing can seem like an impossible (and massively complex) undertaking. The majority of recent grads are just happy to have a job that makes enough to buy food, pay for the rent and for their car, and the occasional trip out with friends. It’s not like they have any extra money just laying around to invest. Plus, for people who don’t have a basic knowledge of investing, it’s easy to quickly become overwhelmed with jargon financial people use like “basis points” or “price-to-earnings ratio.”

Unfortunately, teaching financial basics so people have a baseline of investing knowledge is not emphasized in our schools. Here in Ohio, financial literacy is supposed to be included in the high school graduation requirements, but no one has defined what that means and the curriculum topics covered can vary widely.

So what is a 20-something to do? Let’s walk through some basic investing principles that will serve as a good starting point for the future.

Understanding Risk Tolerance

You wouldn’t think it, but an important part of investing is understanding that it can be emotional.

Are you bold and comfortable making risky choices? Would you be happier knowing you won’t lose it all and as a result take a more conservative approach? Are you willing to risk putting all of your investment into something like the stock market where the reward can be great, but so is the risk of greater loss?

Money is emotional. How do you feel about it?

A risk assessment questionnaire will help you figure out your tolerance. The younger you are, the more you can afford to be more aggressive and to take risks. You will have a longer period to recover any losses, but don’t stray too far from your maximum risk tolerance.

Watching Your Money Grow

Merriam-Webster defines the word “invest” as “to commit (money) in order to earn a financial return.” Seems pretty simple.

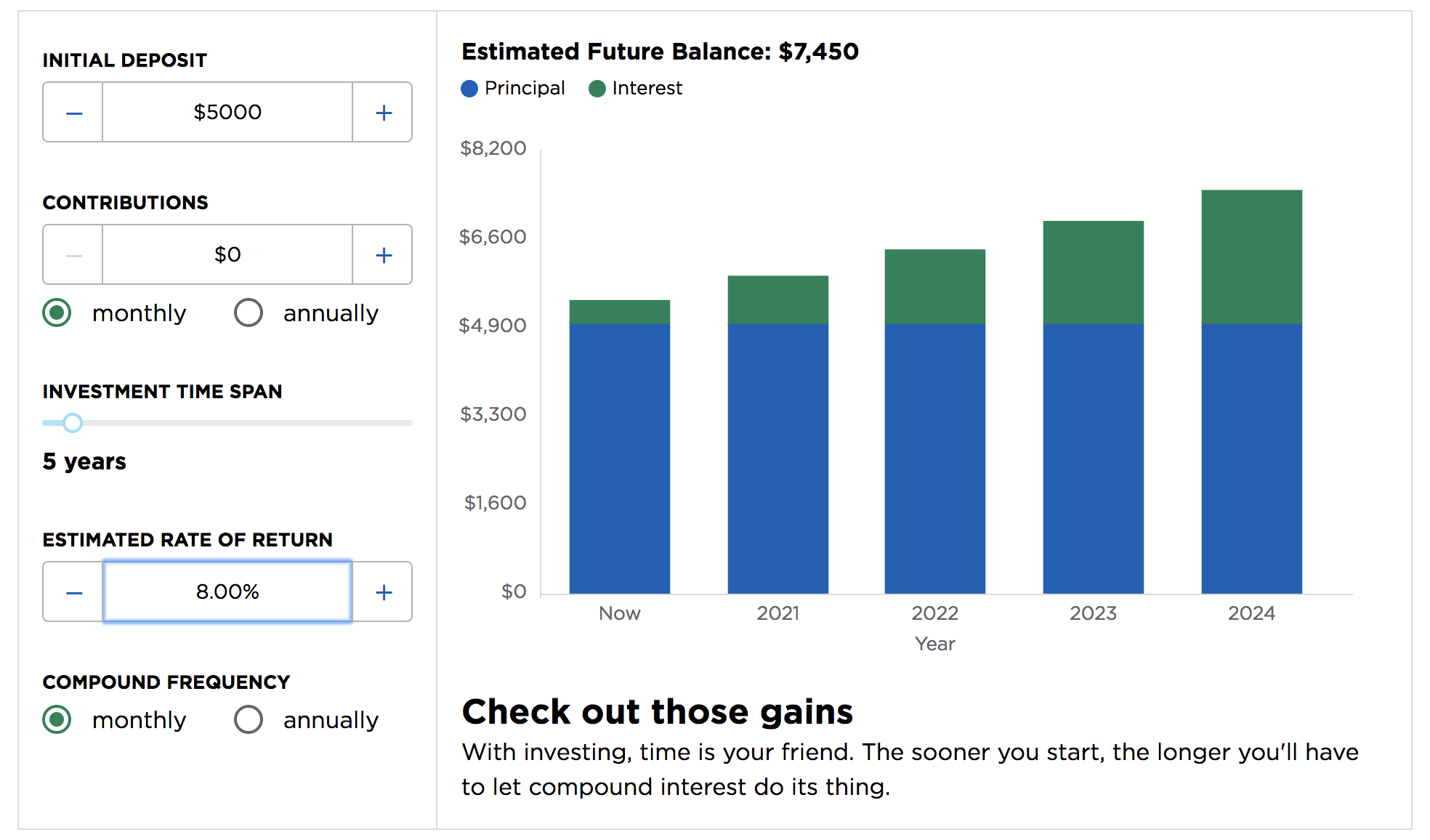

Ideally, to earn the largest financial return, an investor needs to understand the concept of compound interest. The amount of money invested out of your own pocket is the principal. The principal earns interest at a rate which is expressed as a percentage. Compound interest is new interest paid on the interest you earned in the past. Check out this compound interest calculator from Nerd Wallet.

So, you are earning interest on your interest. Let’s say you invested $5,000 for a period of 25 years that has an annual interest rate of 8% and is compounded monthly. You don’t add any more money to the account. That initial $5,000 investment will be worth over $37,000! Pretty cool right? Now let’s say you invested the same $5,000 but you let it grow for a period of 50 years. That initial $5,000 investment will be worth over $269,000! That is the power of compound interest.

It is worth noting that this is assuming that the investment is growing tax-deferred. In our blog, Making the Most of Tax-Advantaged Savings Plans, we review how to choose the right tax-advantaged investment vehicle and the huge impact it can make long term. Now, let’s look at the fundamentals.

By starting early, compound interest will have a huge impact on your future financial situation. Use time to your advantage and plan for the long term to make your money work for you. Starting early (as early as you can) is key.

Stocks, Bonds, and Mutual Funds

Stocks

According to Nerd Wallet, stocks are “securities that represent an ownership share in a company.” Businesses issue or sell stocks to raise money. When a business is successful, they share the profits with their investors or shareholders. Because the success of the business is not guaranteed and outside forces can have an impact on the price of a stock, a stockholder can see the price go up and down at random intervals. Share prices change throughout the day and have an opening and closing value each day the stock market is open. In the majority of situations, stocks are purchased through a broker which can be directly through an online discount broker or through an individual stockbroker. Historically stocks have more risk than bonds, but they also have the potential for more reward. When investing for the long term you must understand that you will have ups and downs and understand the risks and potential rewards.

Bonds

Investopedia defines a bond as a “fixed income instrument that represents a loan made by an investor to a borrower.” An investor buys a bond from a governmental or corporate entity and is in effect giving a loan to that entity that they will use in their business to finance projects. Bonds typically have a set end date and earn a fixed (or sometimes variable) interest rate over the life of the bond. Because the principal amount must be paid back in full at maturity, bonds are a more conservative savings tool as their return doesn’t depend as much on the business’s performance as a stock does.

Mutual funds

A mutual fund is a pool of money fed by multiple investors that is managed by professionals who spread the investment across a variety of stocks, bonds, and other securities. A portfolio manager makes buying and selling decisions on the investors’ behalf keeping a certain level of risk in mind. The benefit to the investor is the expertise of the manager and the relative security of spreading your money across several different investment vehicles. Mutual funds can be purchased directly from the mutual fund company, bank, or brokerage firm.

A quick note about “exchange-traded funds” (ETF):

Like a mutual fund, an ETF is made up of a variety of assets. They are traded like stocks on the market. However, unlike a stock, they are invested in more than one company’s business. ETFs can own pieces of a variety of companies in one focused industry like banking or include commodity or currency investments for example. ETFs are purchased through a broker or brokerage account.

Mutual funds and ETFs are good for the common investor because they provide outside expertise in the choices made and the risk is lower with the investment spread across many different types of assets.

Finding Balance

The perfect balance is what is perfect for you. Keeping your risk tolerance in mind consider whether you have an active or passive investment management style. The active style means you are trading investments often, and it involves more risk. You are timing the market and making choices about what could be the right stock purchases at any given moment. The passive style is also commonly referred to as “indexing”. Passive investments are made with long-term savings in mind. Instead of trying to time the market or pick the winning stock, you buy a fund that invests in a group of stocks like the S&P 500 and hold it for the long term. The idea is to spread your risk across hundreds of companies, diversify your investment, and avoid the high fees you’ll incur with frequent trading activity.

Some final tips:

Pay yourself first…

Of course, you need to make sure you are paying your bills, but above that commit to paying yourself first. Set aside money each paycheck for savings first. One of our favorite rules of thumb is saving at least 10% of your income on an annual basis. If your salary is $50,000, that would mean setting aside $96 per week. If this goal seems too aggressive at this point in your life, do two things. First, take a good hard look at your budget. Be honest with yourself about your spending and take a hard look at what you “need” versus what you want. Second, set 10% as a goal you will work towards. Start with 5% now, then every time you get a raise commit to saving 1% more each paycheck. You will still have a nice raise and you will be making progress towards your long term goals! Saving something is better than nothing.

Automate your money…

Have your payroll set to direct deposit to your checking account. Set up your bills to be paid automatically as much as possible so you can avoid late fees. Take advantage of banking tools that let you transfer a certain amount of money to a savings account each month. Consider electronic statements for your online accounts. Moving money out of your primary account keeps you from spending it on that extra Starbucks you don’t need. 😉

Be aware of fees…

Depending on the type of investment you choose, a variety of fees will be charged by the company making the investment on your behalf. Brokerage firms will charge a transaction fee each time a stock is bought or sold, and they can range from around $5 to $10 for a discount broker up to $150 for a full-service firm that is researching and choosing on your behalf. Mutual funds may have front or end-loaded fees which will charge you a certain amount either at the beginning of the investment or at the end when you sell. These fees matter and can have a big impact on the true return on your investment.

Finally, invest for the long term…

Ignore the “pundits” on TV or the internet promising you quick money. You can’t control the market, and their advice is probably not right for you. If it sounds too good to be true, it probably is. Remember that compounding interest thing and start saving today.