Once upon a time there were two families. Both families had well-paying jobs, and their children were bright hard-workers who were academically successful. The Smith family, Sam and Sarah, had three children. The Jones family, Jim and Jill, also had three children, and just like the Smiths they were lucky enough to have successful careers and gifted students. Early on when the couples were having their children, they realized they would eventually have serious things to pay for college for the kids and retirement for themselves. How would they get it done…the college dream for their children and financial independence for themselves?

Higher education is an important investment. It leads to better jobs, higher incomes, and lower unemployment. People with higher education fare better during economic downturns and typically earn higher wages than high school graduates. Having attended college themselves, the Smiths and the Jones knew the importance of college for their kids, but their financial houses were in different shape.

The Smith’s current situation

When the Smiths graduated college, they each had some serious student loan debt. Today about 7 in 10 college graduates have an average debt of $29,900. For the Smiths, their combined total student loan debt was $50,000. This debt has seriously impacted their financial lives together.

In their house, the first $500 they made each month (their combined monthly loan payment) was already spoken for and would be for the next 10 years. This debt had a direct and an indirect effect on their personal finances that they certainly weren’t thinking about when they headed off to college. According to the Center for Retirement Research, student debt is directly reducing the amount of savings in retirement plans. That may seem an obvious result. A family cannot be investing money into a 401k when it is being sent to student loans every month.

An indirect effect of these loans? Families with student loans have lower rates of home ownership and the value of those homes is less. For most families the value of their home is one of their largest assets later in life after you have successfully paid off the mortgage. One study found that a 10% increase in student loan debt correlates with a 1.5% decrease in homeownership.

When the Smiths were finally clear of their student loan debt, the home they were able to afford was less expensive. They were trying to focus on other areas where they needed to save—college for the kids and retirement. The chunk of time they had to devote to paying their student loans ate up those years of savings for the other areas so they wisely didn’t get in over their heads with a mortgage they couldn’t afford, or qualify for.

How about the Jones family?

Now the Joneses were in a different financial position. The parents of Jim and Jill had recognized the importance of graduating with little to no student loan debt. They had saved what they could, but they also helped their kids to find those schools that would not only be an excellent academic fit but also would be financially affordable—offering merit scholarships to Jill and Jim that helped them graduate with no student loan debt.

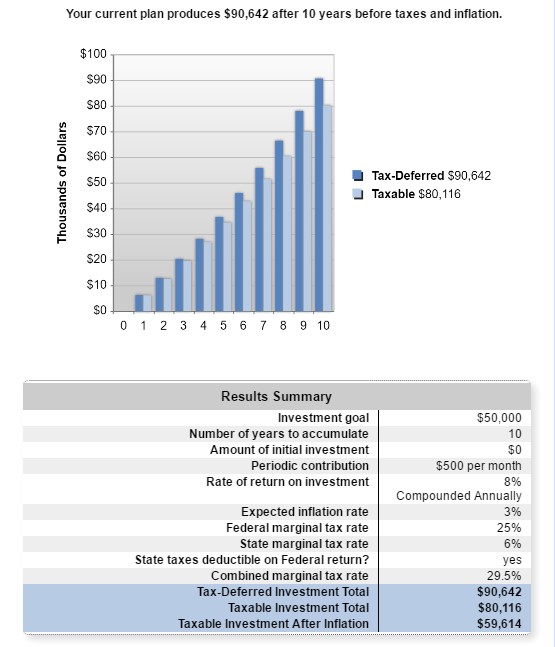

The Joneses were not faced with 10 years of $500 per month loan payments. They were able to save for a home and invest in their retirement. Instead of sending $500 per month ($6,000 per year) to student loan debt, they were each funding their Roth IRA accounts with $3,000 per year for 10 years from the age of 25 to 35. If we assume an investment rate of return of 8% growing tax deferred in their Roth IRAs, at age 35 they would have a nest egg built up of $90,642!

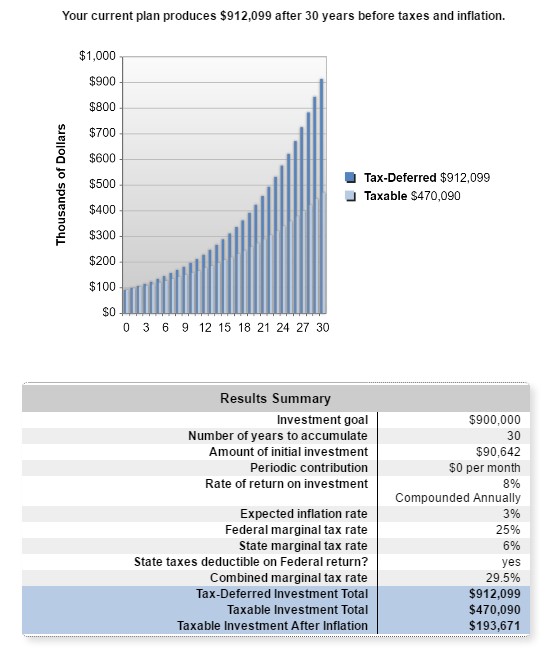

If they never put another dime into their Roth IRA accounts from age 35 to 65 and the investments continued to grow tax deferred at 8%, they would have a total account balance of $912,099 for retirement! Who couldn’t use an extra million in retirement? (Want to check our math? Bankrate.com has some awesome FREE calculators!)

They were also able to buy a home with a higher value then the Smiths and were able to buy it sooner.

Let’s jump ahead in time.

Both the Smiths and the Joneses have their own children to put through college, and both families were able to save some money, although to different degrees. The Joneses did something the Smiths had not. The Joneses had not forgotten the importance of saving for retirement as well.

When our families were finally done putting their children through college, retirement was really not that far away. For the Smiths and the Joneses when they were done paying for college for all three kids, they were 50 years old. Would they be able to retire at 65? Would that be only a pipe dream? One of the keys to realizing that dream is the ability to save for retirement while also paying for college. Not choosing one over the other.

This is easier said than done as every dollar is stretched thin. If you work hard, you deserve to have a comfortable lifestyle now as well. If you have clarity in your goals and they are in alignment with your family values, your decision to pay yourself first and set aside money each month is much easier. There is no silver bullet. Figure out how much you can reasonably save each month after your living expenses are being met and automate your money to fund the appropriate retirement and college savings vehicles. A qualified CERTIFIED FINANCIAL PLANNER™ may be able to help.

College financing and retirement financing have become intertwined as never before.

College is a time of self-exploration, learning, and making lifelong friends. That is what college is all about. Unfortunately for families today, cost is now a factor that must be considered.

Every year millions of 18-year-old young adults are committing to buy a college education—like the Smiths and the Joneses. They aren’t going to college. They are buying a college education with mom and dad’s help of course.

Aside from a home, a college education will be one of the largest purchases they will ever make. Help students go into this with their eyes wide open as to what they are committing to, not only just for the next 4 years but also how much it will cost them down the road in terms of major purchases and saving for retirement. Use this as a lesson in personal finance and consumerism. One of the greatest gifts a parent can bestow upon their children is helping them make smart choices with their money. Give them the ability to pursue things they are passionate about and not be forced to take a job that pays more money just so they can make their student loan payments.

The college years for a parent are one of the most expensive periods of their lives. Imagine receiving a bill for upwards of $30,000 every 6 months for 4 years—all while also trying to save for their own retirement. Families need to make sure they are not overpaying for college for their kids and not getting in over their heads.

No one enjoys telling their kids they can’t have what they want. But if students choose a college that you really can’t afford, they will be faced with a retirement funding gap for themselves due to their student loan payments.

Originally published 4/2016

Updated 5/2020