You’ve been saving in your 529 plan getting ready for that day when your student goes off to college. Well, the day has finally come. What now?! What do parents need to think about? How to pay for college with a 529? What about tax considerations and cash flow?

How can you use your 529 to pay for college? What else do you need to consider?

1) Know your due dates!

Most colleges have early August due dates for the fall semester and December or early January due dates for spring. They are probably communicating reminders with your student who may not always do the best job of reminding you…the one who is paying the bill! Be sure to stay in the loop.

2) Who is getting the funds?

529 plans can disburse money either directly to the institution, directly to you, or directly to the beneficiary (your student). When you log in to your 529 plan online, you can request a withdrawal and indicate the party receiving the funds. Allow enough time between the request and the due date. Sometimes it can take 10 days for the funds to get to where they are going. As the owner of the 529, you can be the recipient of the withdrawal when you need to reimburse covered expenses (like books) that you paid out of pocket.

3) Should I use up my 529 funds first?

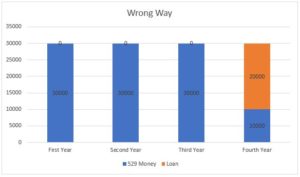

Many parents will make the mistake of using their 529 money to pay all the expenses until it is all gone. They will then turn to loans to cover the remainder.

Maybe the first three years are paid using 529 money, and then the fourth year comes and the family is looking at loans. This is a mistake.

Federal student loans (Stafford) have the lowest interest rates and best repayment options, but they are capped at a certain amount each year: $5,500 freshman year, $6,500 sophomore year, $7,500 junior and each year after in undergraduate education. We call them “use it or lose it” loans.

Here’s an example. A family has saved $100,000 in their 529 plan. (Good for them!) The school costs $30,000 per year. They use 529 money to pay the first year, the second year, and the third year. They are forced to take out $20,000 in loans during the last year. Because the federal loan is capped at $7,500, they will be forced to get loans without the favorable interest rate. You’re looking at private, higher rate loans for the extra $12,500.

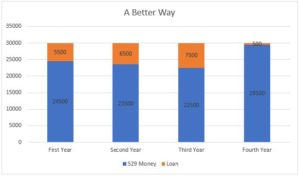

A better way is to use the maximum federal loan available each year. The total loan amount remains the same; however, the result in terms of repayment is much better.

4) Don’t forget cash flow funding.

When your student is at home, they aren’t free, right? Every month you pay for the cost of them living at home. When they go to school, some of these costs end. You can use that unspent money to make payments for college.

Many colleges will accept a payment plan spread out over the semester. Take advantage of it. You want to avoid parent loans at all costs so cash flow funding can fill the gaps.

Also, consider flowing funds through the 529 while in college. Many states, like Ohio, allow for a state tax deduction on the first $2,000. Colorado allows for an unlimited state income tax deduction! It’s a no brainer! Might as well.

5) Use tax credits but don’t double dip.

The American Opportunity Tax Credit (AOTC) equals 100% of a student’s first $2,000 in qualified education expenses plus 25% of the next $2,000 for a possible total credit on your taxes of $2,500. This total credit applies per student. (It is subject to maximum income and other rules that you should be aware of.)

You cannot claim qualified education expenses under the AOTC using investment growth from your 529 savings or Coverdell Education Savings Account. The exact details can be tricky so always consult a CPA for advice. In general, the best idea is to use non-529 money for AOTC qualified expenses.

If your income is below the phase out limits, you should spend $4,000 of your own money (if you can) on qualified expenses to take advantage of the $2,500 tax credit each year.

So, you made it…you’re sending your student off to college. Remember to stay on top of those deadlines, know who you want to pay, understand how to take advantage of federal student loans and cash flow/payment plans, and don’t forget those tax credits. Carefully planning all four years and how to pay for college with a 529 can give you the financial edge.