Trying to figure out how much a college will cost a family is based on many factors including a family’s need and a student’s academic merit or other talent. Determining a family’s need when looking at college costs, can be a tricky task because different colleges come at the problem in different ways.

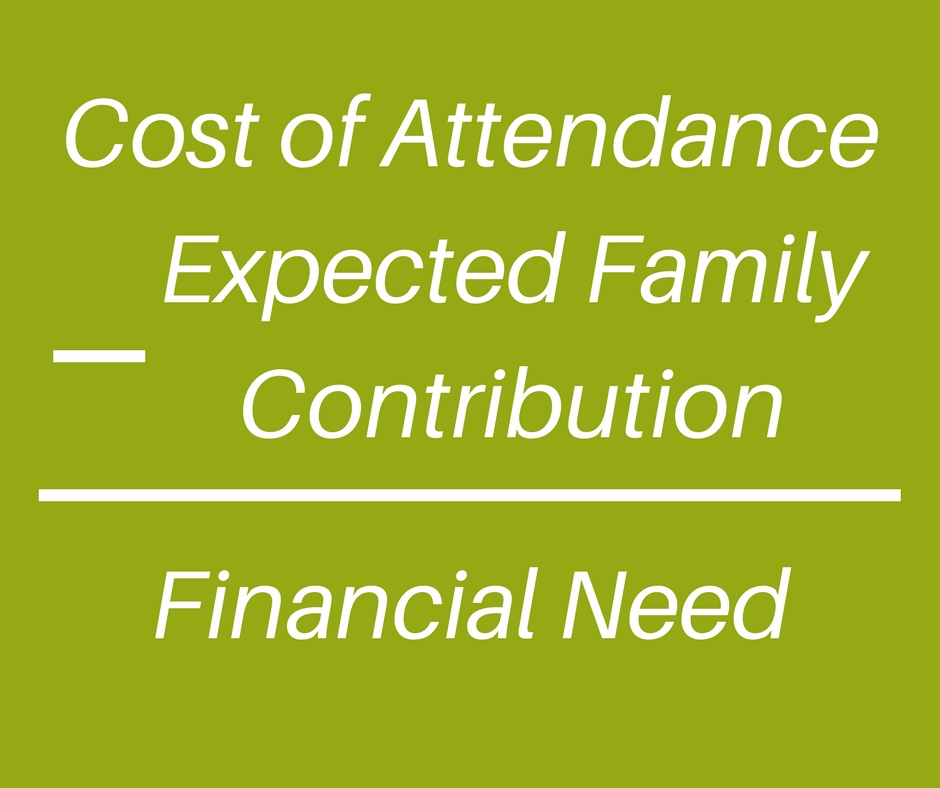

A family’s “financial need” is calculated by subtracting the Cost of Attendance, COA, (tuition, fees, room/board, books) minus the Expected Family Contribution, EFC.

So, how do we figure out EFC? Often, we talk about two different ways of figuring that out: Federal Methodology (FM) and Institutional Methodology (IM). The FM is calculated by completing the Free Application for Federal Student Aid or FAFSA. The IM is calculated by completing the College Board’s CSS/Financial Aid PROFILE®. BUT there is also a third way used by only 24 universities that looks at the calculations in a slightly different way.

Each different methodology could save thousands of dollars depending on a family’s financial situation, but understanding how each works is key to finding those savings.

In the 1950’s, colleges wanted to spread their limited financial aid resources to the most need worthy applicants, and they needed a standard way to calculate it so they partnered with the College Board to create the Institutional Methodology. Today the IM is used by almost 400 schools.

The majority of colleges using the IM today have much more of their own money available to give away as aid. With more money at stake, more detail is required by the college…practically every little detail of the parents’ financial life. In addition to the basic questions, certain colleges may add their own specific questions looking for other additional information.

The IM will look at the income and assets of the parents including any non-custodial parents, business assets, gifts made to the parents, etc. and even the equity in a family’s home.

In addition, the IM goes further by also factoring in the expenses of a family including debt, business expenses, mortgage, medical expenses, parent’s student loans, high school tuition, etc. By including expenses as well as assets, they are trying to get a more accurate snapshot of a family’s worth and need.

In the 1990’s, the US government developed their own calculation or Federal Methodology (FM) to use in the awarding of federal money like Pell Grants, subsidized student loans, and work study. Many colleges also rely on this calculation to determine a family’s financial need when awarding their own aid money. Unlike the IM, the FM only looks at income and assets–not expenses.

The FAFSA is the tool used to collect the numbers for the FM, and the assets include cash, savings, 529 plans, CDs, stocks, UTMA/UGMA, etc. These assets are also included in the IM.

(Important to note: If you own three 529 plans, one for each child, then the grand total of those three plans is the number reported–not the plan balance for the child you are filing for.)

Neither plan penalizes parents for their retirement savings. Amounts included in retirement plans like 401(k), IRA, 403(b), pensions, etc. are not assessed.

Assets are assessed at different rates. Under the IM, parental assets are assessed at 5%. Under the FM, parental assets are assessed at 5.64%. Student assets are assessed at 25% IM and 20% FM.

In the FM, parents have an “Asset Protection Allowance”, an amount you are allowed to have in assessable assets equal to between $17,400 at age 45 and $29,600 at age 65 or older as an emergency reserve fund. This amount will be deducted from your total asset value.

So, let’s look at an example:

IM: $100,000 (non-retirement assets) x 5% = $5,000 (A family’s Expected Family Contribution is increased by $5,000.)

FM: $100,000 (non-retirement assets) – $17,400 (age 45 Asset Protection Allowance) = $82,600 x 5.64% = $4,658.64 (A family’s Expected Family Contribution is increased by $4,658.64.)

The FAFSA FM calculation also includes state tax, income protection, and business adjustments.

In real simplistic terms, the FM looks at income plus assessed assets less any other adjustments. The IM looks at income plus assessed assets less expenses.

Now, let’s throw a wrench in all we’ve talked about. Could there be another way to earn even more need-based aid money? Depending on a family’s circumstances…yes. In the late 1990s/early 2000s, a group of college and university presidents thought that these calculations were not consistent enough from school to school.

So, the 568 Presidents Group was formed. They use a third method to calculate EFC–the Consensus Methodology (CM). Here’s a list of the current colleges using the CM approach. Section 568 is a provision in the Improving America’s Schools Act of 1994 that allowed colleges to meet and talk about financial aid.

The CM uses the IM formula as its base and in many ways with respect to income, assets, and expenses follows the IM formula. Like both the IM and the FM, retirement assets are not included.

A major difference between the IM and the CM is the treatment of home equity. Under the CM, a home’s equity is capped at 120% of the parent’s income. If a parent is earning $110,000, the maximum home equity value reported will be $132,000 even if their home is worth $250,000. Families with expensive homes would be best to explore CM schools if they are choosing between IM and CM colleges.

Student assets are assessed differently too. Where FM is 20% and IM is 25%, CM is only 5% each year. Again, a family’s personal situation affects their opportunity for need-based aid.

The FM plan is the most lenient to divorced families. The IM and CM require the reporting of non-custodial financial information. The FM only asks about the custodial parent (the parent that the student lives with 51% of the time, regardless of who claims them as a dependent on their tax return).

Remember, just because a family has a financial need (our COA – EFC = Need formula), doesn’t mean that a college has the money to give you. Always be aware of which colleges promise to meet those needs. Some can’t afford to.

Confused? Why do we need to know all this? When finding the best college at the best price, knowing the ins and outs of the awarding of need-based aid is a part of the overall picture. Taking a close look at a family’s situation can lead you to different colleges and universities for the best financial fit.