Choosing a College: Weighing the Return on Education

By Joe Messinger, CFP®

March 22, 2024

We often hear the term “return on investment” or “ROI.”

We use those words ourselves all the time at Capstone Wealth Partners.

When you invest, you expect a certain return or increase in the value of the amount you invested over a period of time. College should be viewed through the same lens. Your family is spending a certain amount of money over four years. Down the road, you expect that investment to result in an improved financial situation where your child makes a good salary and continues on an upward career path with as little debt as possible.

Choosing a college is like choosing the best investment for your money. What is the return you get on that education you invest in?

The Class of 2024 is in the home stretch. Soon, they’ll be making the decision about which college they’ll attend. As your student thinks through which school is right for them, it’s important that they understand the time value of money and that the choice they make now will dramatically impact their future financial situation.

Which college should your child attend?

Every spring, we talk with clients who are faced with making difficult choices between two colleges. Choosing a college is all about academic, social, and financial fit. When the final decision is down to College A and B, both great schools without a massive difference in quality, the financial fit can become the deciding piece. In this situation, we have an exercise we like to do to put the return on education in perspective.

Let’s look at an example.

The Smith Family has an academically talented student. They have narrowed the college choice to two; each would be a great school. Because of the excellent scholarship offered at College A, the price for all four years would be $80,000. College B does not provide those kinds of merit scholarships and will cost $180,000 for a four-year education.

The Smith Family is lucky. They can afford to pay $180,000 over four years. It will be a serious stretch, but they can make it happen.

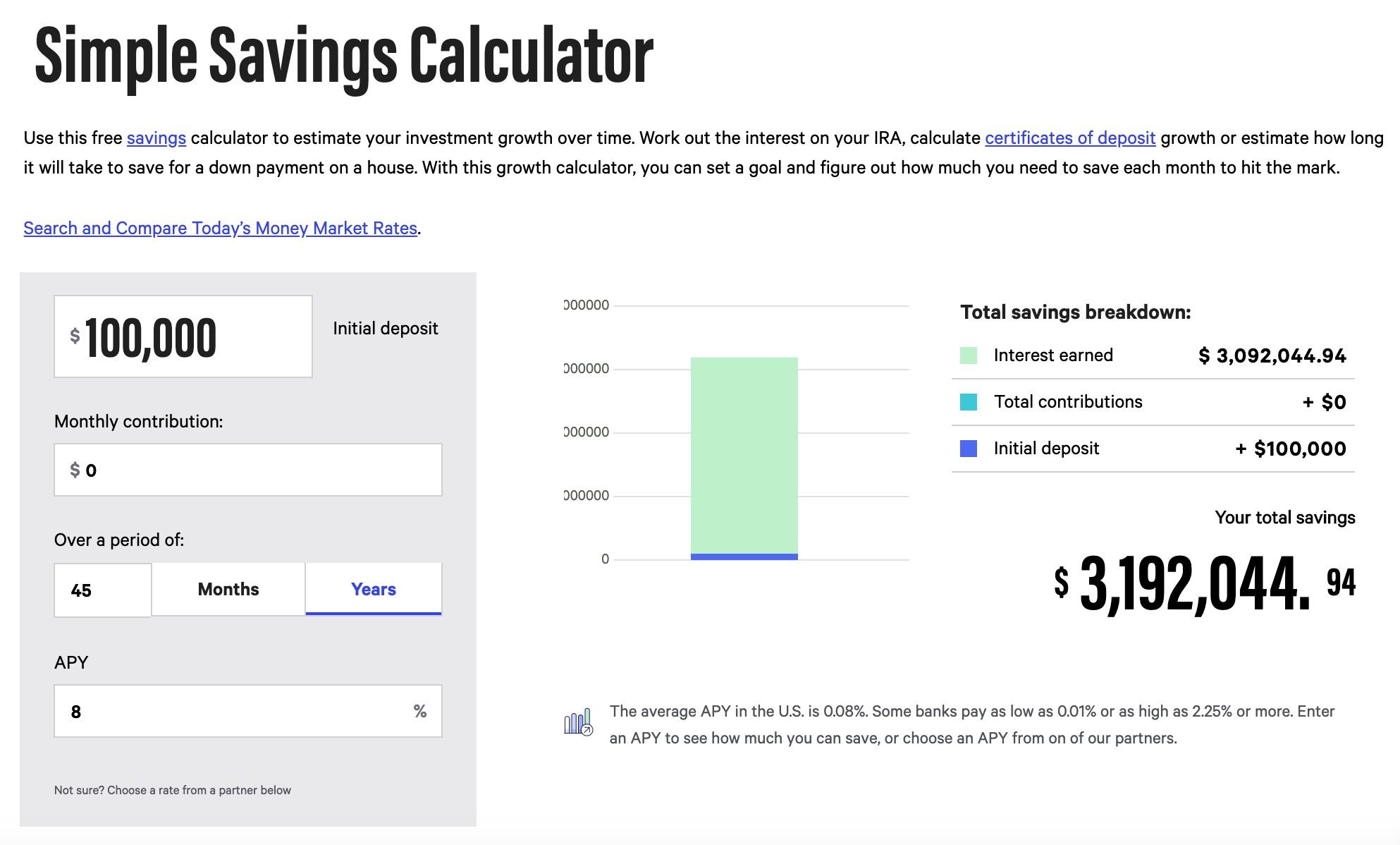

To reframe the conversation, we ask them, what if instead of investing all of that money in education at College B, you took that extra $100,000 and invested it from now until their child’s retirement in 45 years? Growing at 7%, they would have over $2 million. Growing at 8%, they would have over $3 million!

Simple Savings Calculator from Nerdwallet

Will the education at College B result in an additional return of $3 million in their child’s adult life?

Maybe, but probably not.

We have written about those rare times when paying a premium for college is worth it. But for most majors, College A, which also has a great program for their child, will be an excellent choice.

Too often, the higher education marketing machine has blinded parents to one important fact. Success in college is more about what your student does there than what college it is. If you doubt this statement, read Frank Bruni’s book “Where You Go Is Not Who You’ll Be.”

Choosing a college with some perspective.

When you’re faced with a college choice and each tick off all the academic and social boxes, look at the cost comparison from a different perspective. The long-term return on education can be an eye-opening experiment.

Originally posted May 2020

Updated March 2024