In Part 1, we looked at college planning with tax strategies higher income families can use including gifting appreciated assets to your child and personal tax filings.

Today, we’re going to take a closer look at the special opportunities available to business owners.

The key to knowing how to cut the cost of college is based on your family’s unique situation.

In other words, you have to take the “full ride” scholarship that your friend got with a grain of salt. Often a business owner will fit in what we call the high merit/low need category. Meaning they earn too much to qualify for financial aid based on need, but their student may qualify for scholarships based on academics.

We focus on a couple of buckets to look to for aid:

- Non-need merit aid offered by institutions based on GPA and test scores

- Private scholarships (not need based)

- School selection – We can’t stress this enough. Find those schools which will award the non-need based merit aid for your child.

- Test prep – Can the ACT or SAT score be raised to earn more merit money? Going from a 31 to a 32 could mean $35,000 over four years.

- Tax aid – Utilizing the system to your advantage.

These 5 “buckets” will result in an ultimately lower net cost to you.

In this blog, we’ll explore bucket number five–tax aid–a bit more in depth.

Families sometimes need to think outside the box to realize the most savings and utilize their own student’s tax capacity.

A great option to consider is hiring your young adult to work for your business. They need to work, be documented, and on the payroll. They can keep the books, sweep the floors, take out the trash, shred documents, or whatever would fit into your business.

Your accountant will need to structure this properly for you. They can be sure you are not overpaying your student, and everything is documented properly. Aside from the tax benefits, having your kids be a part of the business is an exciting way to train the next generation continuing your business.

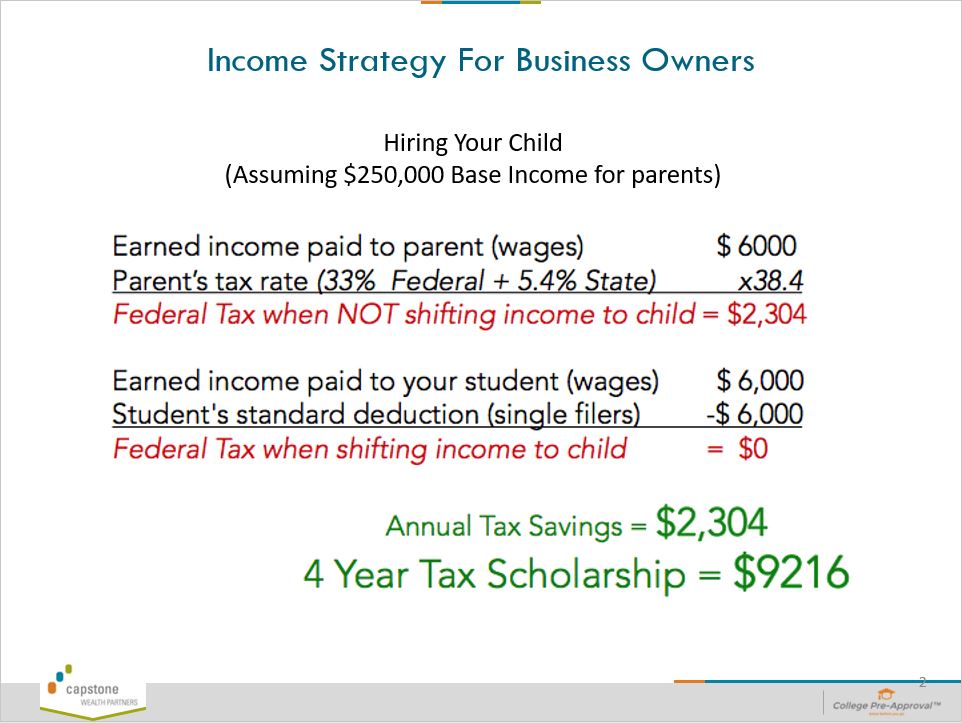

You can implement this strategy your child’s junior or senior year to start, but you don’t have to wait until your student is actually in high school. From a mechanical standpoint, it is quite simple. Let’s use this chart as an example:

strategy for business owners

Let’s assume the base income for parents is $250,000 putting them in the 33% federal tax and 5.4% state of Ohio income tax brackets. The $6,000 earned by the parents would result in a $2,304 tax due, and a net take home pay of only $3,696.

If you paid your student employee that $6,000 instead, the student’s standard deduction for single filers of $6,000 would result in no tax due on this money. An annual tax savings of up to $2,304 or $9,216 for four years.

We like to refer to this tax savings as a “tax scholarship”–realizing savings that were not there before.

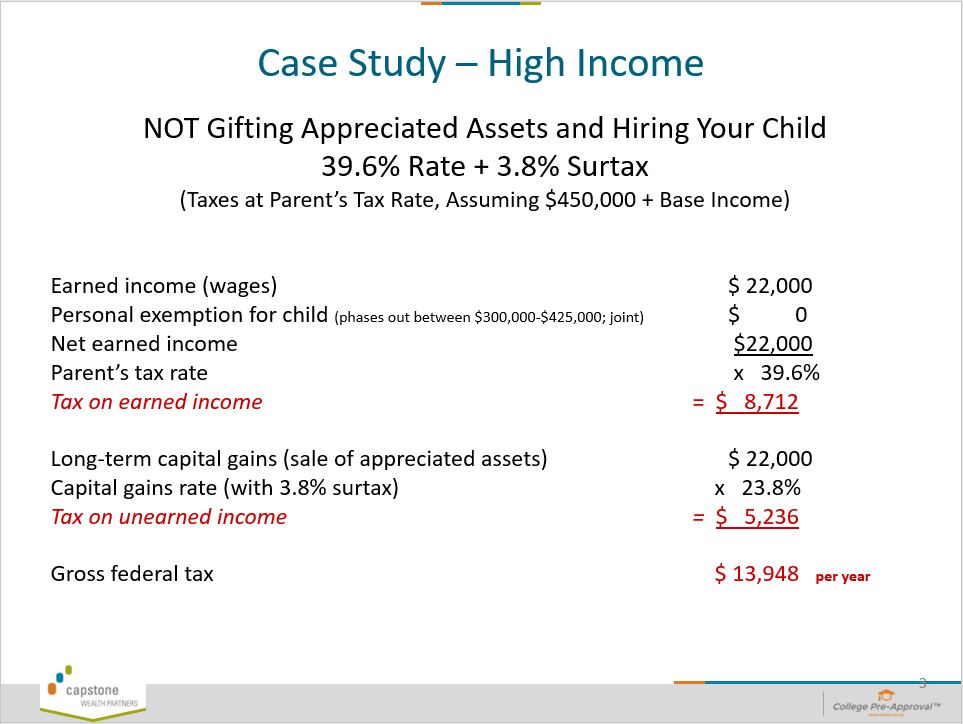

Let’s take a look at an ultra-high income family like a doctor or dentist with an income over $450,000.

Perhaps your children want to follow in your footsteps in this career, and so you employ them in your business. What happens to the tax picture when you can gift appreciated assets to your child and hire them in your practice? Let’s compare these two scenarios:

This case study is a family we worked with in 2013 that was trying to figure out the best way to pay a $50,000 bill from a college. The student is now a senior and set to graduate this year. So we will show you the results for one year, but this strategy was used each of the 4 years.

With the parent’s $450,000 income, they are subject to an income tax rate of 39.6% or $8,712 tax on their earned income of $22,000. Plus if they sold appreciated assets of $22,000, they pay 20% plus 3.8% surtax for a total of $5,236 in long-term capital gains tax. The combined total of these is $13,948 gross federal tax per year. OUCH!

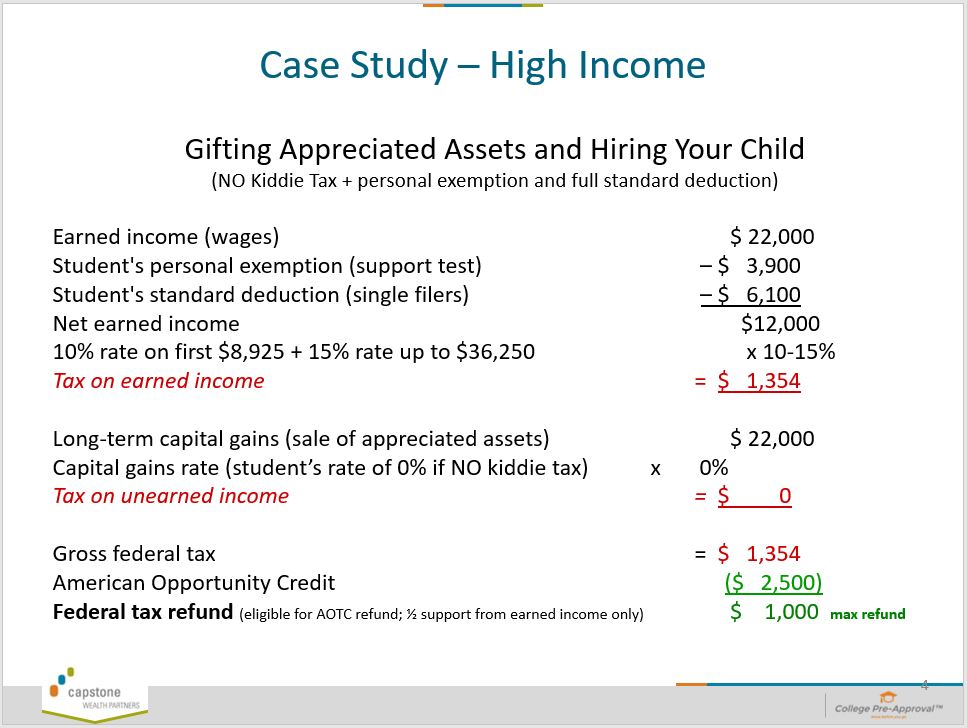

As an alternative, pay the student that income and gift the appreciated asset to the student.

If the student meets the “support test” (paying for more than half of their expenses on their own via earned income and sold appreciated assets), they can file their own taxes as shown in the second graphic. In 2013, the student’s personal exemption of $3,900 and their standard deduction of $6,100 are deducted from the $22,000 earned income. Their tax on this income will be $1,354.

The sale of the appreciated assets gifted to them by you the parents to pay for college is not subject to capital gains tax. Why? The student is not subject to the kiddie tax because they meet the support test. They will not be subject to any tax on this unearned income.

The parents were not eligible for the American Opportunity Tax Credit because they had a modified adjusted gross income above $180,000. However, the student can claim the American Opportunity Credit of $2,500 on their taxes to offset the $1,354 tax on their earned income and receive a total federal tax refund of $1,000, the maximum refund available under this credit.

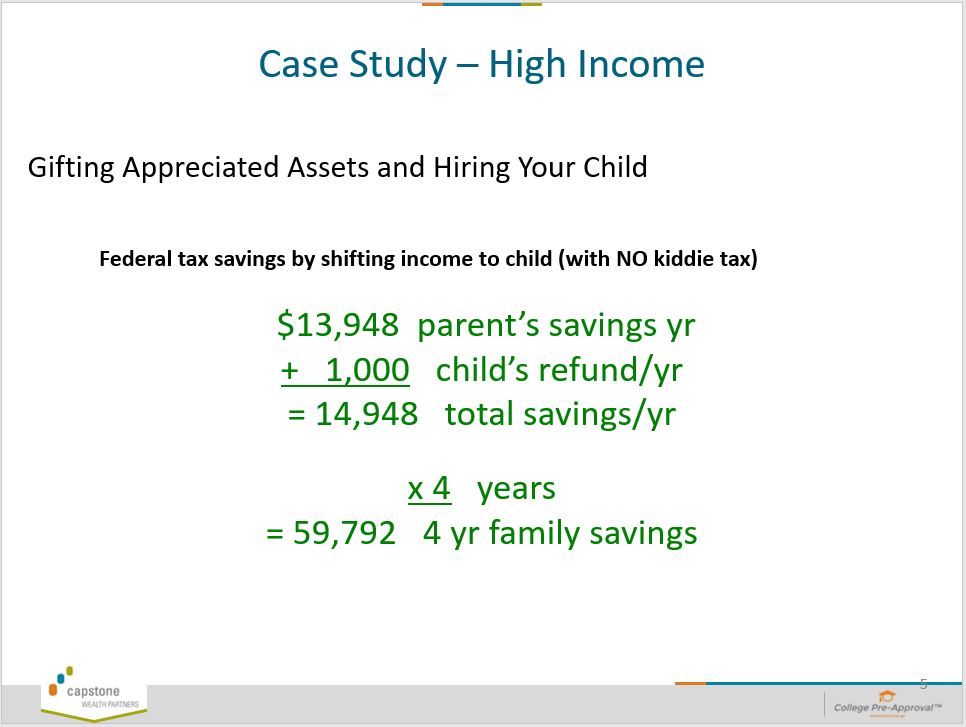

Wow, right?! Let’s look at a summary of all this:

In the second scenario, you avoided paying the $13,948 tax and your child received a $1,000 refund for a total savings of $14,948 per year. Over a four-year period, the total becomes a $59,792 savings!

One more idea to explore…tuition reimbursement plans.

These plans are a great employee benefit to consider if you can afford them. The employer benefits from smarter employees who are more easily promotable, improved retention, and competitive recruiting when looking for new employees.

If your child is an employee filing their own taxes, they can apply for the tuition reimbursement as well. Businesses are eligible to write off $5,250 per year per employee for tuition reimbursement plans under Section 127.

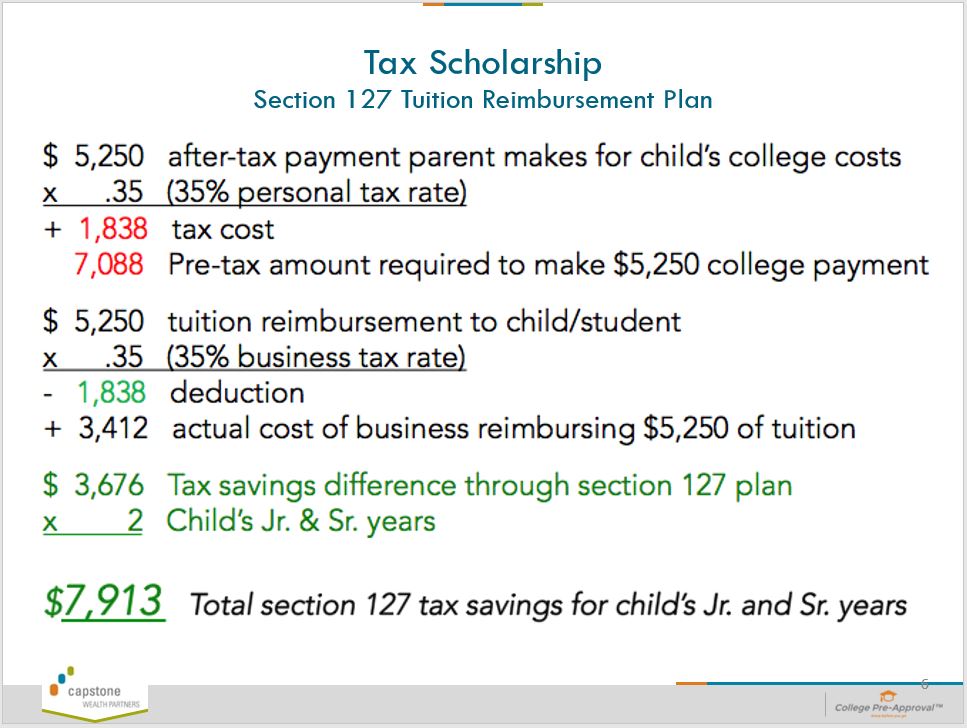

Parents paying $5,250 in after-tax money to a college are using dollars that were subject to their 35% personal tax rate. It costs them $7,088 in pre-tax money to make that $5,250 college payment.

If they reimbursed their student via the tuition reimbursement plan, the business sees a deduction at the business tax rate or a $1,838 deduction in our example here. The actual cost for the business is $3,412 to reimburse $5,250 of tuition…a savings of $3,676 per year.

Take note. This benefit is only available to those over 21 years of age. Taking advantage of this plan may have to wait until the junior or senior years of college or graduate school. If you can put this plan into practice, you’ll see a $7,913 tax savings for those two years of college.

The above example is taking advantage of Section 127 of the Internal Revenue Code and comes with dollar limits and administrative requirements for employers. The benefit must be offered to all employees. A written plan must be in place. However, the education does not have to be job related.

A different option is under Section 132, Working Condition Fringe Benefit. Section 132 does not have dollar limits and does not have to be offered to all employees. A written plan is not required (although it is a good idea). Benefits can include travel expenses. However, the education must be job related. The government may closely examine whether a college course is related to the employee’s current job. Section 132 may be a better idea for your business.

A caution to all readers…

We are not tax professionals. We wanted to show you some examples of ways to wind everything together to maximize all savings opportunities.

Most tax professionals file taxes for you. However, they are not tax planners and will not suggest these types of strategies. They will be more than happy to help you implement them and get all the i’s dotted and t’s crossed. You will need a tax professional to help you make and implement a plan. We just want you to see the possibilities.

We believe strongly in leaving no stone unturned. We want to show you how things can be different by using college planning with tax strategies.

Get your tax savings optimized to ultimately CUT THE COST OF COLLEGE!