Our Tips for Minimizing the Cost of College

The reality today is not all marriages last forever. When a marriage results in children and those children grow up to be college-bound students, you need to know how your divorce impacts your college cost bottom line. Add to that remarriage and blended families, you can easily make mistakes that will cost you when applying for financial aid. The good news is the financial aid system can work to your benefit if you know how it all works!

Understand how your EFC (Expected Family Contribution) is determined

Let’s briefly lay the foundation for how all of this works. Whether a divorced family or not, the federal government has devised a formula to determine your family’s share of college costs known as the Expected Family Contribution (EFC). Using the Free Application for Federal Student Aid or FAFSA (which we have mentioned before), you fill in your financial information, and the formula will tell you the amount that they think you can afford. You file the form each year, and your EFC amount is determined each year your student is in college.

WARNING! Your EFC amount may make you laugh and/or cry at the same time!

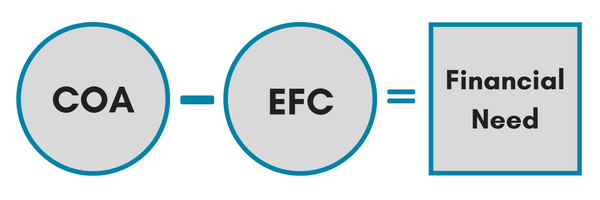

The basic formula for need based aid is the cost of attendance at the institution minus your EFC equals how much financial aid you are eligible to receive.

Be aware even though you are “eligible” to receive need based financial aid that does not mean the institution can meet your full need. A very important statistic to review for colleges you are considering is the “percentage of need met.” This percentage can make a huge impact on your out of pocket cost.

A side note – Remember this, the sticker price of the college is irrelevant. Never rule out a school based on the “sticker price”. Focus on your “net price” after scholarships and grants are awarded.

Know how the FAFSA differs from the CSS Profile®

Most schools use this “federal methodology” to calculate your EFC and to determine how much aid you are eligible to receive; however, not all do.

Some 400 schools use the CSS Profile® which looks at a family’s financial situation very differently especially in the case of divorced parents. (Click here to read more in detail about the CSS Profile®.) The CSS Profile® uses the “institutional formula” to determine your EFC and how much financial aid you are eligible to receive from the college you attend.

So, remember that the FAFSA uses the “federal methodology” and the CSS Profile® uses the “institutional methodology” to determine your EFC, and they can produce a wildly different number for divorced parents.

Determining who is the “custodial” parent

Why is the “custodial” parent so important? In the world of college financial aid, the “custodial” parent is NOT the same as what you report on your tax returns. This is a common mistake made by parents. When determining aid, the custodial parent is the one the child lives with the most during the past 365 days. It does not matter who claims the child as a dependent on their tax return.

A common mistake families make is reporting to the federal government the income from ALL parents—mom, dad, step-mom, and step-dad. Don’t over report. It will lower the aid you receive.

On the federal FAFSA application form, “parent 1” is the “custodial” one—the one who the child lived with the most. “Parent 2” on the federal application is NOT the “non-custodial” parent. “Parent 2” may be the step-parent in the household if the custodial parent remarried. Or it will be blank if the custodial parent has not remarried. Just answer appropriately for marital status and the online system will guide you through the process.

If the custodial parent lives with someone and they contribute to the household financially, their income will be reported as non-taxed income. They are included as they are considered part of the household and helping to support it financially.

The federal FAFSA form does NOT want to know the financial information of the “non-custodial” parent. They will ask about child support the custodial parent is receiving as part of that household’s income. But the income of the non-custodial parent is not included.

The CSS Profile® form is different. It DOES want to know the income of the non-custodial parent, and it wants to know the income of BOTH custodial parents. Basically it wants to know everything.

With the CSS Profile® the custodial parent is responsible for including the information of the non-custodial parent on their filing. Some schools do not require the non-custodial parent to report the information directly to CSS/PROFILE® themselves. However, some colleges will ask the non-custodial parent to fill out a separate filing. Either way that might be an awkward situation for certain families. Just remember, this is for your son or daughters financial aid. Set your personal differences aside and get it done.

A case study

Our college-bound student lives primarily with her mother—only spending the weekends with her dad. Mom works and earns $45,000 per year. Dad also works and earns $300,000 per year. Mom is not remarried, but Dad is.

FAFSA: Parent 1 is mom. Parent 2 is blank. Dad’s $300,000 is not reported. This student’s EFC will be very low because it is based solely on mom’s income and her financial information. The student will want to find FAFSA schools meeting his high financial need.

CSS Profile®: The total $345,000 income is included. If the college requests the non-custodial parent (dad) to complete his own filing, the school will look at the information of mom and dad and often strip out the income of mom’s spouse (if she had one). If the school does not request a separate filing from dad, they will include mom, dad, and mom’s spouse (again, if she had one). Either way, the result has a huge effect on this student’s need.

If mom and dad truly have joint custody, a strategy to consider is to have the student live with the less financially successful parent one more day per year and focus on finding FAFSA schools meeting a high percentage of need.

Do your research

You want to carefully think about your family’s situation and find the colleges which will provide your student with not only the best academic and social fit, but also the best financial fit. You want to find those schools where you will receive the most aid. Being knowledgeable about the financial aid policies of each institution you are considering is critical.

In our example, the family will want to explore colleges that utilize the FAFSA and fulfill their student’s financial need. The CSS Profile® colleges will expect that family to pay much more.

Always consider a quick call to the financial aid office of your student’s colleges of interest to see how they calculate aid. If they are CSS Profile®, will they require a separate filing from the non-custodial parent? How will all of it work? Remember, whether or not they require a separate filing may impact whether or not the custodial step-parent’s income will be included. The financial aid office is there to help. They won’t tell you how to get more aid, but they will gladly walk you through exactly how their institution’s process works.

Each school using the “institutional” method to determine your EFC can have different reporting requirements and assess resources differently. If it sounds confusing, that’s because it is. So why do they look so much deeper? Institutions using the CSS/PROFILE® typically have significant endowments per student and hence large scholarships and grants to award.

Set your personal differences aside

These situations are emotionally stressful: who pays for what, the sharing of personal information, being forced to communicate where communication has been difficult or lacking.

Ideally, divorced couples should spell out how they will handle college in the divorce settlement, but the divorce may have been many years ago.

Regardless, plan ahead and get a good understanding of all the complexities involved. Extend a branch to your ex and create an open line of communication about this important decision. If not possible, you may need an unbiased third party to act as a mediator and advocate for your child.

Remember, this time in the life of a high school student is already extremely stressful. Don’t let the financial discussions make it worse for them. This doesn’t mean keeping all of this a secret from them however. Young adults tell us over and over that they want to be part of this conversation. Be honest and open with them about the financial aspects.

Have the knowledge you need in hand to find the best choices for your student. And remember that the common goal is doing what is in the best interest of your college bound son or daughter. Do your best to set your personal differences aside and find a school that is a great academic, social, and financial fit.