At Capstone, we share ideas and create college funding plans with parents so their future college graduate does not suffer with an excessive student loan debt load. We are always trying to be proactive. However, we are often asked “what can I do now?” when the being proactive ship has sailed, and a graduate has their first job. All too often, graduates are faced with large debt balances. Their income is modest. They feel overwhelmed. Just this week a graduate asked us what she could do so here are some tips we like to share:

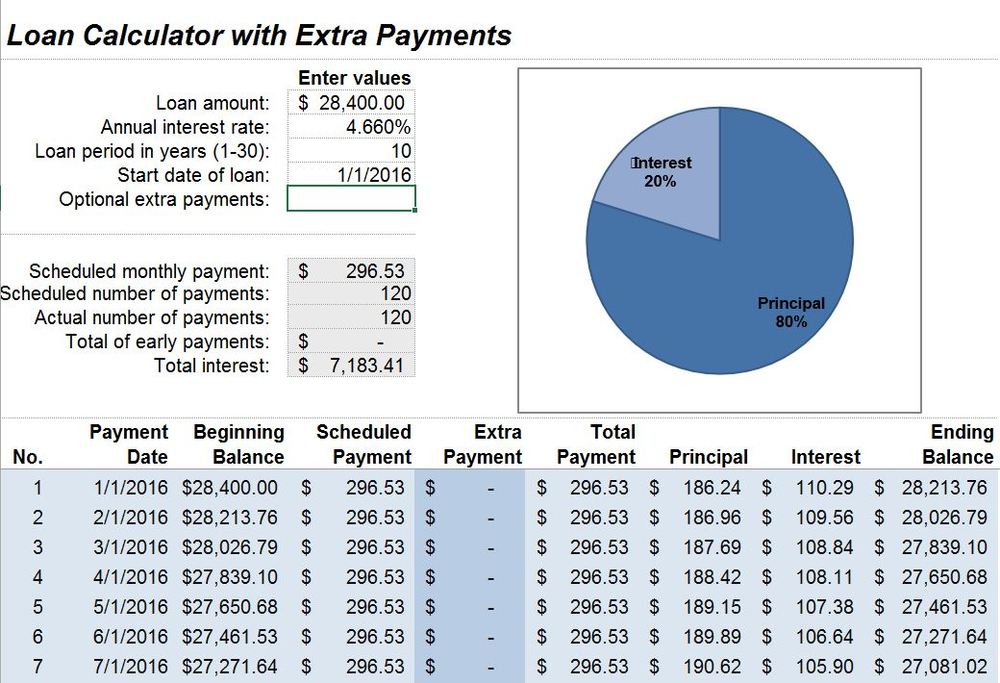

First, know this…you are not alone! In 2013, 7 of every 10 seniors had college loan debt with an average $28,400 per borrower. Using the standard 10 year repayment schedule, this amounts to a monthly payment of just over $300. (Click here for a helpful student loan debt calculator.) College graduates are putting off life decisions like getting married, buying a house, or having children because of their debt.

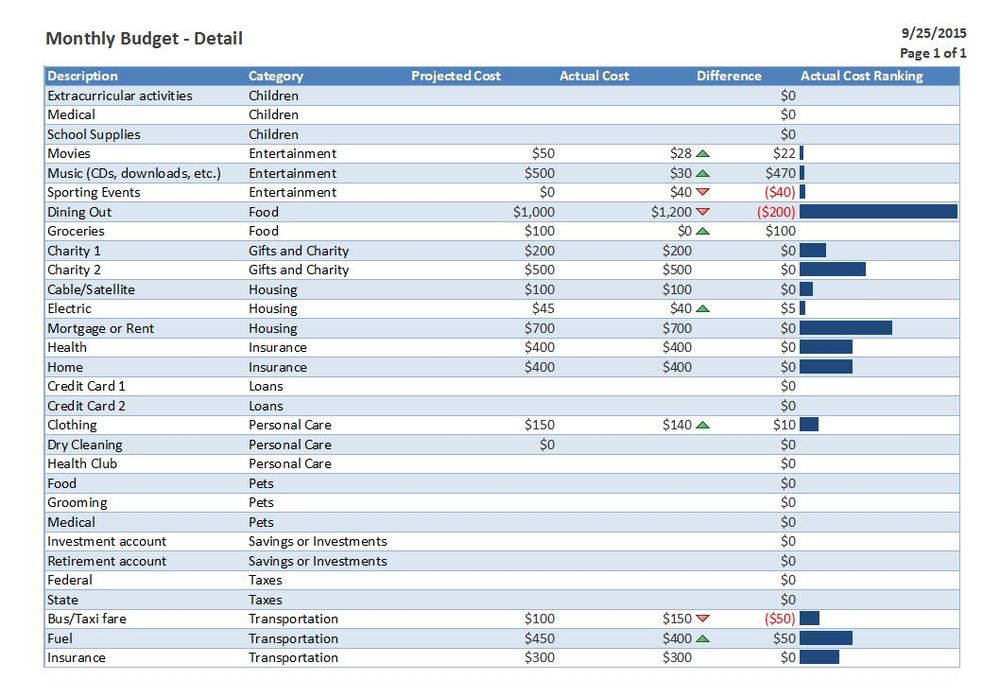

Second, you have to face this challenge head on and accept responsibility. Paying off debt is challenging but not impossible. Create a budget and live within your means. Find creative ways to reduce your expenses like making your own coffee at home, packing your lunch, taking the bus instead of a cab. A lot of little things can add up. Check out our budget worksheet you can use. A great free online tool for budgeting and staying up to date on your spending is Mint.com.

In addition, if you haven’t already, take the time to explore the variety of repayment options. Federal Direct Stafford Loans have several different repayment options to reduce your monthly payment. You can choose: an extended repayment plan to stretch the payments out evenly over 25 years instead of 10, a graduated payment plan to lower payments at first and increase them gradually every 2 years, or a variety of income based (IBR) and pay as you earn repayment plans. But proceed with caution; the longer you stretch out your payments, the more interest you will have to pay over the life of the loan. Visit ibrinfo.org or studentaid.ed.gov for more information.

Can you imagine if you had $100,000 in debts and a monthly payment of over $1,000 when you were starting your career?! For most people, the Federal direct loans are not the problem. They have maximum amounts you can borrow each year, and you cannot exceed a total of $27,000 over a 4 year undergrad degree. Private student loans are the problem. They have virtually no limit to the amount you can borrow. Private loans can lead students to get in over their heads quickly, without having any idea of the consequence. These loans are directly with banks, have limited flexibility, and widely variable terms.

If private loan debt is your problem, explore consolidating your loans to get more favorable interest rates and more manageable lower monthly payments. Check out websites like sofi.com and simpletuition.com, as well as a number of credit unions who may offer better terms to consider. I encourage you to work with your current lender as well as other institutions to get the most favorable terms.

Our final tip is actually a warning…CAUTION: Companies out there will make claims they can wipe out your debt if you pay them a fee. DO NOT fall victim to deals that sound too good to be true. If it sounds too good to be true, it probably is!

We don’t have a magic wand to solve a large debt load, but we wanted to share a few ideas you can explore to lessen your burden. Perhaps you want to share your story with others? We would love your comments below. Tell them to be proactive—know the amount of debt they are comfortable with and find the perfect fit college for their budget. Capstone can help!