The Ohio State University sees record numbers…again!

Last year at this time, we were writing about the record high average ACT scores for incoming Ohio State Main Campus freshmen (28.9 in 2015). Guess what…the newest OSU class of freshmen has surpassed that record yet AGAIN. What’s the new number? 29.2!

In addition, 49,388 prospective applicants applied to become Buckeyes this year—an increase of 7.6% over last year’s record number of applicants. The economic principles of supply and demand are making it increasingly difficult to become a Buckeye at Main Campus.

What the heck is going on here?

In 1995, the average ACT score was 22.8 for the incoming freshmen class. Now in 2016, we find ourselves at 29.2. What is going on? What is the driving force behind this increase in test scores and applicants at our colleges? Are our kids getting smarter?

No. They really aren’t. The national average ACT composite score has essentially been unchanged hovering around 21 for the last 10 years. This average doesn’t give us a complete picture though because not all the testers feeding into this average were college bound—some needed to take the test as part of high school assessments so their scores may be bringing the average down a bit.

In Ohio, the average in 2015 was 22.0 with 73% of high school graduates tested. So obviously, The Ohio State University, a flagship state school, is becoming much more selective about admittance to main campus because of the sheer number of applicants wanting to come here.

Is it just a football thing?

No. Although success on the football field certainly does help bring awareness of a brand name to the world. The internet and the marketing machines that are colleges today make sure their name is out there. Not only because of athletic success but also with their message of the quality education available at these colleges.

In our post from last year, you can read about the impact of Ohio State’s reputation in the global marketplace. Out-of-state and international enrollment figures are soaring. At flagship universities across the nation, administrations are seeking out the increased tuition figures that come with non-residents.

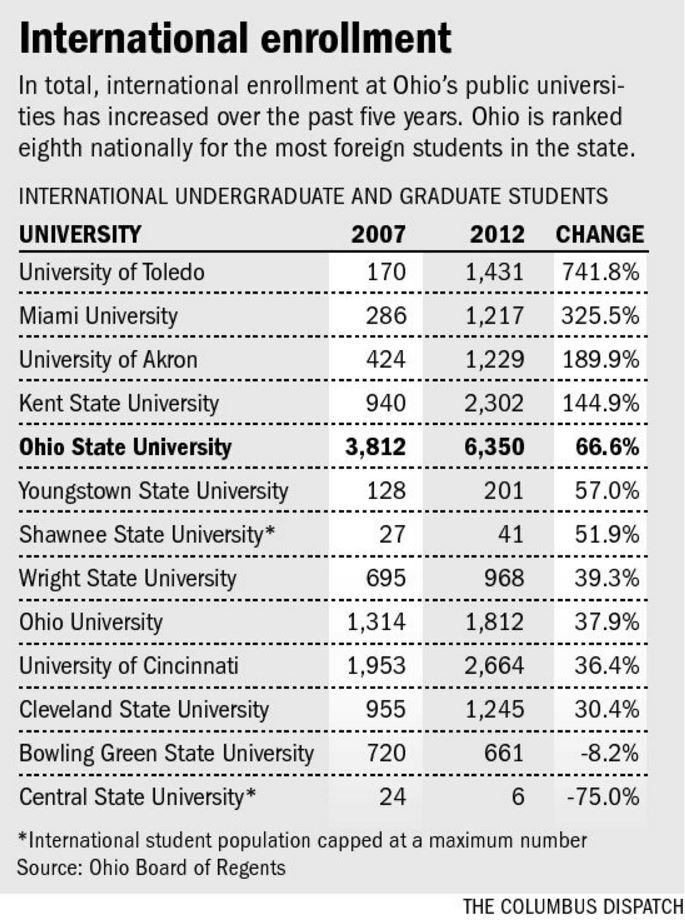

You can see in this graphic from the Dispatch that many Ohio colleges and universities are seeing increases in the numbers of international students.

In the 2014/15 school year, Ohio State ranked 14th in the nation in the number of international students enrolled with 7,121, a 4.7% increase from 2013-14, according to the report.

It’s a good problem to have, right?!

Almost 50,000 students completed the Common App and sent it to OSU with the hopes of becoming a Buckeye. The total number of students who will enroll remains about the same from year to year. You can do the math—number of applications rising, spots open for new students staying the same, college can become more selective choosing the best of the best.

A funny cycle begins to form. When test scores rise and rates of admission fall (more applications vs. number of enrolled students), a school becomes more highly selective. When a school becomes more highly selective, their rankings with US News and the like rises. When their ranking rises, more applications come pouring in. And around and around we go.

So what if your child is dying to be a Buckeye (or a Nittany Lion or a Badger or that animal from up north)?!

Do your best in high school and remember that schools balance the ACT score with your GPA. If you have below the school’s average ACT but a high GPA that can make up for a lot.

Maybe some extra test prep for the ACT exam? Be aware though that even some extra test prep may not be enough. Getting a 29 or above on the ACT is really a challenging task.

Keep things in perspective also. The national average ACT composite score was a 21 last year. So, if you score better than a 21 you outperformed half of the other graduates!

What to do if that 29 is just unreachable for your student? Remember that you are still above average on a national level with a 22+ on the ACT. Hundreds of schools would love to have you attend and will even compete with scholarship dollars to get you! Expand your search beyond just the big name brands and find great schools you will excel at.

Consider a branch campus. The extensive network of branch campuses and partnerships with community colleges allow flexibility and serious cost savings with the same end result—a degree from your number one college.

Branch campuses allow for an easier transition to the college atmosphere as well. Get good grades as a freshman, and you have a high likelihood of being admitted to the main campus as a sophomore.

Don’t view the lack of acceptance at the main campus of a flagship university as a failure. Look at OSU this year…about 42,000 other students are in the same situation! Make sure your student understands this and doesn’t feel like a failure.

Finally, don’t let the appeal of your state’s flagship university blind you to all the options out there. You can find a good academic, social, and financial fit for your student at hundreds of wonderful institutions. Be realistic with your chances of being admitted to your top choice schools and have a Plan B and Plan C, AKA safety schools.