In early June of 2015, the Department of Education announced revised Federal Need Analysis Methodology to determine a student’s EFC for the 2016/17 award year. In August, the DOE made a correction to their original figures, but the result is still not good news for middle class families hoping to receive need-based aid! We haven’t seen much in the media about this topic so we at Capstone wanted to make sure you have the information you need to “Know before you go!”

As we’ve discussed in prior blog posts, the EFC, Expected Family Contribution, is a number representing the amount the government expects your family to pay towards a college education every year. If your EFC was $25,000, the government would expect your family to pay that amount each year. If tuition from your chosen school was higher than $25,000, you might be eligible for need-based aid for the difference. To learn more about the FAFSA and EFC check out these posts: “Determining the Bottom Line“, FAFSA, FAFSA Part 2, Financial Aid Policies, and College Visits.

As part of the EFC calculation, the government annually determines a certain dollar amount to be considered as a parent’s Savings and Asset Protection Allowance. This allowance protects a portion of net worth (assets less debts) from being considered available for postsecondary educational expenses. In other words, this amount would NOT be included in the total available assets used to calculate the EFC. The thinking being parents are not expected to spend their ENTIRE savings on a college education. (Note that retirement accounts like 401(k), 403(b), and IRAs are not considered assessable assets for financial aid purposes.) The recent government decision has drastically cut this protected asset figure.

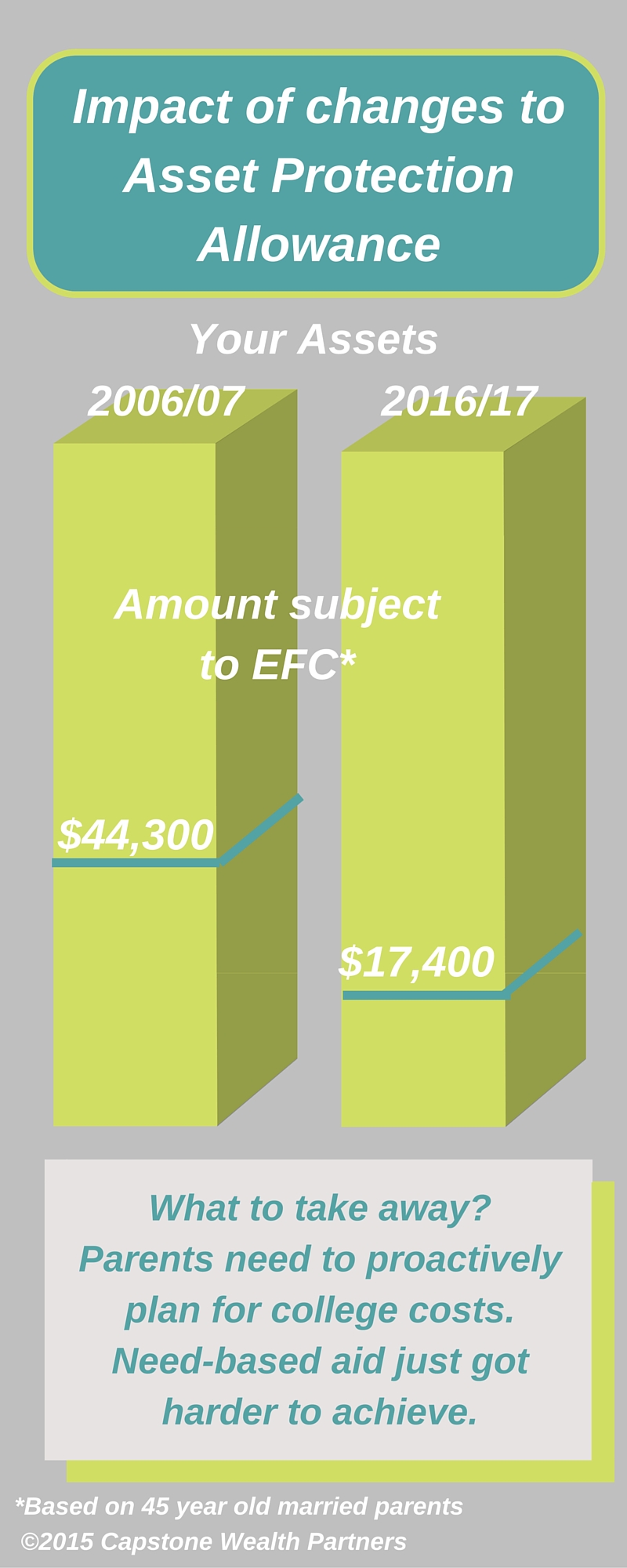

LET’S LOOK AT A COMPARISON — 2006 VS. 2016

Ten years ago in the 2006/2007 year, a 45-year-old two parent household’s protected asset value was $44,300. (Click here for Federal Register documentation.) Any amount higher than this protected amount is assessed a 5.64% rate resulting in what the government expects a family to pay towards their child’s education from their savings. If your family had a total savings of $100,000 including savings, checking, 529s, etc. in 2006/07, you were expected to put $3,141 of your total assets towards college for the year.

After the DOE’s August correction starting in the 2016/2017 year, the protected asset value will be $17,400. The same family’s protected savings value went from $44,300 to $17,400! If a family has the same total savings of $100,000 in 2016/17, you will now be expected to put $4,659 of your savings towards college that year—making need-based financial aid further out of reach.

What does this mean to middle-class families? It means need-based financial aid just got harder to get. It means costs will continue to rise as federal and state programs continue to shrink. It means parents and students will be expected to pay for college themselves more than ever before.

Every parent knows they need to be saving for college, but the reality is dollars are stretched thin for families across the country. Our general guidance for parents is to save as much as you can as early as you can for education but balance saving for college with saving for your own retirement. Another important thing to consider are ways to save ON the cost and not just FOR the cost of college.

First things first, determine your family’s EFC early so you know if you will qualify for need-based aid. If so, find schools known for meeting 100% of your demonstrated need. If you determine you are NOT a candidate for need-based aid, stop thinking about it! Students need to work hard for merit scholarships and find those schools awarding merit aid for that hard work. Parents need to focus on more advanced income, asset, and tax strategies. With proactive thought, you can create a plan to graduate on time with manageable student loan debt (given your chosen profession) without robbing retirement.