As of year end 2024, there is $1.78 trillion in loan debt spread across 45.3 million borrowers.

How did we get here? The increase in tuition is directly related to the free-flowing market of student loans. If I were in the lending business, I would love to have a loan on the books that is not able to be bankrupted.

More often than not, students and parents are forced to take out student loans to help pay for their college costs. Loans come in two forms – federal and private (bank) – and no matter who you borrow the money from, you will need to repay it with interest so you need to understand the different types of loans and how they work.

Types of Federal Loans

The U.S. Department of Education’s federal student loan program is the William D. Ford Federal Direct Loan (Direct Loan) Program. Under this program, the U.S. Department of Education is your lender.

There are three types of Direct Loans available:

- Direct Subsidized

- Direct Unsubsidized

- Direct PLUS

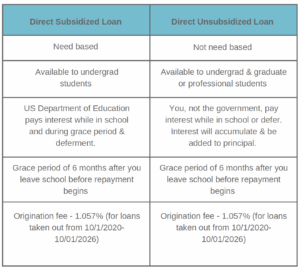

Here are some quick facts to help you understand each…

Direct Loans

The student loan nearly every family will consider is the Direct Federal loan—subsidized and unsubsidized.

How much can I borrow?

Both the subsidized and unsubsidized Stafford loans have loan limits based on your student’s grade and dependency. (Dependent students whose parents were denied a Parent PLUS loan can borrow at independent student limits.) Here is summary of the annual loan limits available under the Federal Stafford loans:

Other Types of Federal Loans

Direct PLUS Loan:

- 2025-26 Academic year:

- Graduate Plus Loan – Graduate or professional studies

- Annual Borrowing Limits: COA – Financial Assistance Received

- Repayment for graduate student is deferred until they leave school. Interest accrues and is capitalized.

- Loan fee (deducted from disbursement amount) – 4.228% (for loans taken out between 10/1/2020-10/1/2026).

- Parent Plus Loan –Parents of dependent undergraduate students

- Parents must be approved with a good credit history.

- Annual Borrowing Limits: COA – Financial Assistance Received

- Repayment for parents may be deferred if requested.

- Loan fee (deducted from disbursement amount) – 4.228% (for loans taken out between 10/1/2020-10/1/2026).

- Graduate Plus Loan – Graduate or professional studies

- 2026-27 Academic year and beyond

- The “One Big Beautiful Bill” had a significant impact on Plus Loans

- Graduate PLUS loan

- Elimination of the Program: The Graduate PLUS loan program will be eliminated for new borrowers starting on July 1, 2026.

- Grandfathering: If you borrowed a Graduate PLUS loan for your current program before July 1, 2026, you will be “grandfathered in.” This means you can continue to borrow Grad PLUS loans for up to three more years, or until you complete your program, whichever comes first. This applies only to the program for which you’ve already borrowed.

- Parent PLUS loan

- New Borrowing Caps: Starting July 1, 2026, Parent PLUS loans will have new annual and aggregate limits:

- An annual limit of $20,000 per dependent student.

- A lifetime limit of $65,000 per dependent student.

- Grandfathering: If you borrowed a Parent PLUS loan for your child before July 1, 2026, you will be grandfathered into the previous, uncapped borrowing rules for up to three additional years or until the student completes their program, whichever is first.

- New Borrowing Caps: Starting July 1, 2026, Parent PLUS loans will have new annual and aggregate limits:

More information about federal loans is available from the Federal Student Loan website.

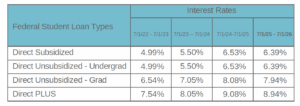

What’s going on with interest rates?

Here is a new schedule of rates for Direct and PLUS loans:

What about private loans?

Private loans are made by banks and financial institutions and is the most rapidly growing section of education loans because the loan amount you can borrow is not limited.

Students and parents should only consider a private loan after they have maxed out all the federal loan money available to them. Interest rates, loan fees, and repayment terms can vary immensely.

Be careful to compare the payments you will face. Some banks will offer relatively low loan interest rates, but higher up-front fees. To compare, a 3 to 4% up-front fee equals a 1% higher interest rate.

Parents, you also need to be aware in many cases you will be required to be a co-signor on your student’s loan to obtain a competitive rate. Ultimately these loans could become your responsibility if your student is unable to repay them. If you are not comfortable with co-signing, we recommend you have a conversation long before Junior heads off to college.

Our Soap Box

After working with hundreds of families over the years, please allow us to get on our soap box. We recommend you estimate your total loan balance and resulting monthly payment for your student’s ENTIRE college career BEFORE deciding on a school. Never take out more in total student loans for a degree than you anticipating making your first year out of college with that degree.

Some Final Things to Consider

Will the monthly payment be an amount you or your student can afford? Here is a good monthly payment calculator you can use to compare your loan options. As a rough estimate for every $10,000 you borrow, your payment will be $100 to $125 per month on the standard 10-year repayment schedule.

Do you want to compare different colleges that your student is interested in? Check out the College Money Report™ so you can compare schools side by side.

Your total balance should never be more than you anticipate making your first year out of college. Not sure what your student might be earning after they graduate? The Bureau of Labor Statistics has wage data on over 800 occupations to help you.

We talk so much about the student loan problem, but all the proposed solutions are reactive—after the fact—such as Income Based Repayment, Pay as You Earn, Public Service Loan Forgiveness, etc. We need to shift our way of thinking, America, and take a proactive approach to graduate on time with manageable student loan debt without robbing retirement!

We are here to help you make the best college decision for you and your students so they can be on the best path after college. Sign up for your College Pre-Approval™ Session today!