What do we mean…FREE MONEY?! At Capstone, we want you to leave no stone unturned, no money left on the table. You need to be an informed consumer of a college education. You need to be familiar with important college-related tax credits and how YOU can take advantage of them.

The American Opportunity credit covers up to $2,500 of undergraduate costs annually.

In 2009, Congress replaced the well-known Hope Scholarship credit with the more generous American Opportunity Tax Credit (AOTC). Senate Bill 699, American Opportunity Tax Credit Permanence and Consolidation Act of 2015, made this tax credit permanent.

The American Opportunity credit equals 100% of the first $2,000 of a student’s qualified education expenses plus 25% of the next $2,000. The maximum annual credit is $2,500. Unlike the other education tax credits, the AOTC includes expenses for course-related books, supplies and equipment that are not necessarily paid to the educational institution. Room and board expenses are NOT qualifying expenses.

Who can claim the credit?

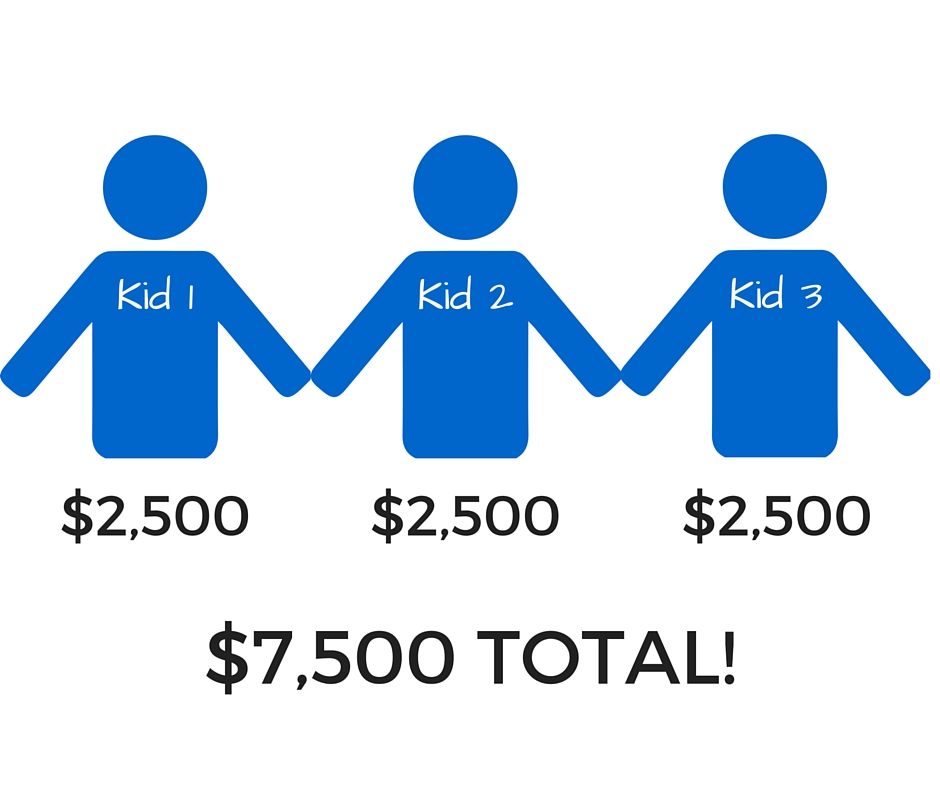

You can claim the American Opportunity Credit for qualified education expenses you pay for a dependent child as well as for expenses you pay for yourself or your spouse. If you have several students in your family, you can claim multiple credits based on the expenses of each student. For example, if you have three kids in college, you can claim up to $7,500 ($2,500 x 3) in American Opportunity tax credits.

The AOTC can be claimed in the same year that you take a tax-exempt distribution from a section 529 plan or a Coverdell Education Savings Account, but the distribution may not be used for the same qualified higher education expenses. So, be sure to spend $4,000 of non-529 resources to ensure you qualify for the maximum AOTC. Many families may be planning to use all 529 money for the first year or two and then tap other resources. To ensure you get the AOTC, each year you need to carefully coordinate a four-year funding plan.

The Credit is available to be claimed four times per eligible student. In other words, the credit is not allowed for a student who has four or more years worth of college credits as of the beginning of the year.

You can only claim the credit for a year the student carries at least a half-time course load for a minimum of one semester beginning in that year. It is worth noting that the academic year and the tax year are not the same. The academic year is divided over 2 tax years. For instance the expenses from the 2020-21 academic year could potentially qualify for AOTC in both the 2020 and 2021 tax year. Additionally, the student must be enrolled in a program that leads to an associates or bachelors degree or some other recognized credential.

Which expenses are covered?

Expenses covered by the credit include tuition and mandatory enrollment fees and the cost of books and course materials. Room and board do not count as qualified expenses nor do optional fees to cover things like student health insurance, athletics and activities.

Students must attend an eligible institution. You can visit www.fafsa.ed.gov if you want to verify that it has a Federal School Code. Almost all accredited public, nonprofit and for-profit postsecondary schools, including many trade schools, are eligible.

Income phase-out rule

The American Opportunity credit is phased out if your modified adjusted gross income (MAGI) exceeds certain levels. (MAGI is adjusted gross income plus certain tax-free income from sources outside the United States.)

Regardless of your income, you are not eligible if you use married filing separate status.

- The MAGI phase-out range for unmarried individuals is $80,000 to $90,000.

- The MAGI phase-out range for married couples filing jointly is $160,000 to $180,000.

What if You Make Too Much Money To Qualify For The Credit?

If you are not able to claim the AOTC because your income exceeds the $180,000 (MAGI) phase-out threshold, here are two ideas to consider:

1. Maybe your child can claim the credit on his or her tax return. If you cannot, or do not claim the AOTC (or any other tax credit or the tuition and fees deduction), and you also do not claim that child as a personal exemption on your tax return, your child can claim the American Opportunity Tax Credit on his or her tax return. This option should be explored by high income families that have students with earned income. Work closely with your tax professional to determine if you achieve more tax savings by claiming your child or not claiming them given the AOTC and other considerations.

2. You might be able to drive your MAGI down below the phase out threshold by maximizing tax-deductible contributions to your qualified retirement plan (401(k), 403(b), 457, SEP IRA, etc.). Let’s say you are eligible to participate in the 401(k) plan at work. The elective deferral limit that you can deduct for 2019 is $19,000, and if you are over the age of 50 you are eligible to contribute an additional catch up contribution of $6,000, for a total of $25,000.

For simplicity, let’s say your current MAGI is $180,000. If you contributed $20,000 more to your pre-tax 401(k) plan, this would reduce your MAGI dollar for dollar to $160,000. In addition to boosting your retirement savings, which is always good, you also saved $7,000 on your current year taxes (assuming 28% Federal, 5% State, 2% Local tax brackets) as you maximize your current year contribution and reduce taxes. Assuming you spent $4,000 of non-529 dollars on qualified higher education expenses, you now qualify for the entire $2,500 tax credit. Over four years of college that results in significant tax savings for that year and boosts your retirement nest egg for the future!

American Opportunity Credit is partially refundable.

Your American Opportunity credit is 40% refundable. That means a portion of the credit will be refunded to you even if you don’t owe any federal income tax.

Here’s how it works…Say your American Opportunity credit is $2,500. The refundable portion is $1,000 ($2,500 x 40%). That amount is treated as a payment on your tax return (as if you had the $1,000 withheld from your wages).

The remaining $1,500 ($2,500 x 60%) is a nonrefundable credit that provides a benefit to you only if you owe federal income taxes. If you don’t owe any federal income tax because of deductions and other credits, the entire $1,000 refundable credit counts as a tax over-payment and is refunded to you.

The Lifetime Learning Credit is another college-related tax credit.

The Lifetime Learning credit covers up to $2,000 of undergraduate and graduate school costs. For the traditional four year college student enrolled full time, the AOTC almost always provides the most tax savings, but the Lifetime Learning Credit should not be overlooked. The Lifetime Learning Credit equals 20% of up to $10,000 of qualified education expenses. The maximum credit is $2,000 before any phase-outs.

Eligibility rules and qualified expenses

The Lifetime Learning credit can help cover undergraduate costs for a student who is not eligible for the American Opportunity credit because he or she is carrying a limited course load or already has four years of college credit. Additionally, the Lifetime Learning credit can also help cover the cost of graduate school and of courses taken to maintain or improve job skills.

You can claim the Lifetime Learning credit for qualified education expenses you pay for a dependent child as well as for yourself or your spouse. However, the maximum amount of covered expenses is $10,000 no matter how many students you have. This translates into a $2,000 maximum credit ($10,000 X 20%).

Logically, you can’t claim both the American Opportunity credit and the Lifetime Learning credit for the same student for the same year. However, you can potentially claim the American Opportunity credit for one or more students and the Lifetime credit for up to $10,000 of qualified expenses for other students in your family.

Income phase-out rule

Like the American Opportunity credit, the Lifetime Learning credit is phased out if your modified adjusted gross income (MAGI) exceeds certain (much lower) levels:

- The MAGI phase-out range for unmarried individuals is $57,000 to $67,000.

- The MAGI phase-out range for married couples filing jointly is $114,000 to $134,000.

Regardless of your income, you are not eligible if you use married filing separate status.

Claiming the tax credits

The rules for these tax credits can be tricky— coordinating your 529 tax exempt distributions, handling a refundable portion of the American Opportunity credit, deciding if the Lifetime Learning credit is applicable, retirement plan contributions, and the list goes on. Each situation is different, and there is no one size fits all approach.

To ensure an ideal outcome, create an integrated plan for your college and retirement goals that incorporates smart investing and tax planning strategies. A tactical plan of exactly how you will pay for all four years down to the penny is a central part of your overall course of action. Make sure you leave no stone unturned and take advantage of your free money.