This week’s guest blog post comes to us from Capstone’s friend, Beth Probst, owner of At The Core LLC. She wrote an open letter to the Class of 2017 this week about the many changes affecting them in the college application process. We thought this information was important to share with our readers as well.

Dear Class of 2017:

A lot is changing in the college application process, and frankly, your child (and the whole Class of 2017) is caught in the middle. Because we are immersed in this world and recognize the impact, we created this “open letter” to you so you can be aware of the changes and what you can do now to prepare. The whole process of college selection, applications, visits, financial aid, testing, etc. can be overwhelming – we get it! We are here to help. (Sorry this is lengthy…there is a lot for you to know, though.)

Testing changes

If your current junior has not taken either test yet, we recommend they schedule one ASAP. Don’t forget: our ACT/SAT webpage has a TON of information in one spot about the tests. Check it out first before deciding on which test and what date.

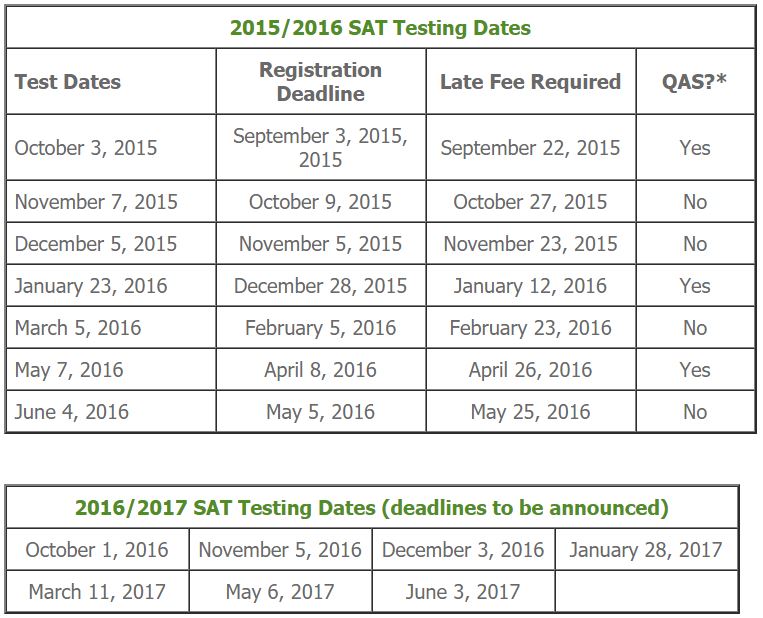

The new SAT rolls out in March 2016. Scores for the March test will not be released until AFTER the May test is scored….too late to decide to take it again in the spring. We share this so your student can consider this fact in their planning.

For Class of 2017, you need to be aware a college your child applies to MAY REQUIRE SAT scores from the new SAT and may not accept old (pre-March 2016) scores. Most schools are saying they will accept either, but be aware and look for specific requirements for schools you are considering. This is a moving target area right now!

When your student accesses the ACT or SAT website to schedule their date, they should allow 30 minutes for the process – lots of questions. They will also need to upload a photo (can be done afterwards). The remaining dates for the 2016 ACT and SAT are:

Two more quick tips….first, if your student takes tests like these and the scores do not reflect the type of student that they are, you may want to look in the “test optional” movement. A growing number of schools will allow your child to apply to the college without submitting any standardized test scores; they are evaluated on their grades, curriculum, activities, etc. You can read more (and see a full list of schools) here.

Second, a small but impactful step your teen can take to prepare for the tests is to sign up for (and actually do!) the “question of the day” for each/either test. The ACT’s is here, and they can follow on Twitter or Facebook. For the SAT, look here.

Financial Aid process

Another change, just for you! In the past, the FAFSA (Free Application for Federal Student Aid) has gone live in January for seniors. For your future senior, this timeline will change. The FAFSA application will open for you three months earlier than in years past in October 2016. As a result, you will use numbers/information from your 2015 tax year/filing. If you sense that you can or should do something to impact your numbers, you have until the end of December (yes, this month!) to do so. We always recommend contacting our favorite college money resource, Joe Messinger of Capstone Wealth Partners, at 614-754-7805.

Common App

Juniors can start now…Get a free ID/password and jump in. The demographic data will carry over to next year for your account; it’s our understanding that college information will not carry over. This change was made to allow students to get a jump on seeing the application and getting some parts done early. Over 600 schools accept The Common App; it’s likely that some of the schools your child applies to will be Common App schools.

School selection

NOW is the time to collect a list of schools of interest. If you have not done a college visit with your student, consider scheduling one very soon. Most school districts allot a number of excused visit days (for example, Olentangy extends three per year for the junior and senior years). You may be tempted to visit over break, on vacation days, or on a weekend; families tell us you will find more value to visiting on a day when classes are in session.

Begin a list now of your family’s college selection criteria: distance from home, undergraduate enrollment size, setting (rural, urban, etc.), quality of major program the student is considering, graduation rate, cost, etc. This list can drive your decision making process. Without this list, the colleges you visit will tell you what is important and cloud everyone’s thinking! Our friends at Capstone have a College Visit Scorecard you might find helpful.

Experts agree: do not exclude a school based on the top-line cost. Private schools will often offer “discounts” to significantly reduce the costs, especially for students they want to attract to their university. Cast the net wider…it never hurts to apply! We especially like the college search/research tools on CollegeData.com and CollegeBoard.org.

Finally, we have compiled a huge list of helpful tips and links on our Resources webpages. Find them here…

Guided Self Assessment

If all of this is overwhelming and you don’t know where to start (seriously….how do they pick a major AND a college???), CLICK HERE to learn more about At The Core’s Guided Self Assessment process. It’s so easy to focus on the college selection! Yet, is that really where you should start? Will that get the end result that everyone wants?

Students will tell you that they go to college because they want a good job that pays them well (that they enjoy). If a student enters the process by thinking of that potential/targeted job, then the next natural thing to consider would be the major to study to prepare for that job. Finally, you can consider what colleges meet your family’s decision criteria.

Contact At The Core for more information and with any questions about what you’ve read…it’s a lot to absorb, but we’re here to help!

–Beth Probst, Founder and CEO of At The Core LLC

Wow! Class of 2017, you have a lot to take in here. Please remember to share this information with other high school junior families. They’ll be glad you did. If you have questions about the financial impact of these changes, please do not hesitate to email or give us a call. Like Beth, we’re here to help! –Joe